Contributed by: Nicholas Boguth

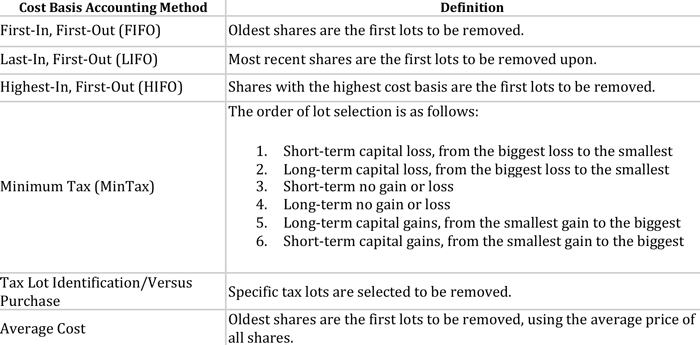

Cost basis: one of the many things we at The Center monitor in order to serve our clients. Most of us know that cost basis is the original value of a security (usually the purchase price), but a lesser known fact is that there are many different accounting methods used to calculate tax liability when the decision is made to sell a security. The table below describes the different methods available.

This is important because the incorrect accounting method could lead to an unnecessary or unexpected amount of capital gains. Hypothetical example: you bought 50 shares of Tesla back in 2012 when it was $30, and another 50 shares in 2014 when it was $200. Now it is 10/5/16, and you went to sell 50 shares at its current price of $210. How much of your sale would be considered capital gains? Well, if your accounting method was FIFO, the answer would be $180 per share, whereas if your accounting method was minimum tax (The Center’s default option) then it would be $10 per share.

The outcomes between accounting methods can be drastically different, and each method has its place depending on your objective. Decision-making from client to client may vary which is where the help of a financial professional can come into play. Please read our Director of Investments, Angela Palacios’, CFP®, Investor Ph.D. blog for insight into more strategies that The Center practices in order to help minimize tax burden.

Nicholas Boguth is an Investment Research Associate at Center for Financial Planning, Inc.® and an Investment Representative with Raymond James Financial Services.

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Nick Boguth and not necessarily those of Raymond James. This is a hypothetical example for illustration purpose only and does not represent an actual investment. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.