Contributed by: Timothy Wyman, CFP®, JD

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

The elimination of the corporate Alternative Minimum Tax (“AMT”) and a new single 21% tax rate provides significant tax savings for corporations. In general, this is viewed by most as a net positive, at least in the shorter term, for earnings that can influence stock prices and the overall economy.

The purpose of this blog post is to focus on how the TCJA provisions may affect our clients that own businesses and specifically Pass-Through Entities such as partnerships, LLCs, or S corporations.

At this early stage, we see a few potential opportunities and potential trends:

Many business owners will want to review the appropriate legal structure of their company in 2018.

Pass-Through entities may see significant tax reductions

Due to the “Pass-Through entity” changes discussed below, some employees will likely consider becoming independent contractors

Large service businesses may consider converting to C corporation status

Pass-Through Entities

Pass-Through entities general include partnerships, LLCs, and S corporations. Essentially, the net income from the business flows through to the owners; meaning they pay federal income tax at their personal marginal rate, as high as 39.6% in the past.

The good news is that many of these entities, and therefore their owners, will experience meaningful reduction in income taxes. The quid pro quo is that the tax system in this area has become more complex.

How might Pass-Through Entities benefit?

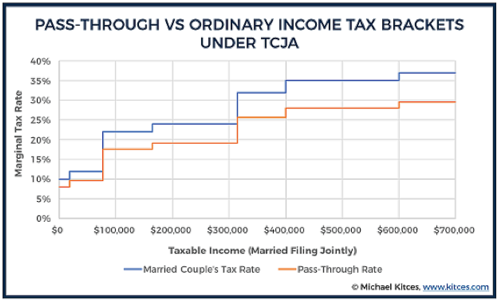

The TCJA provides for a 20% deduction on what is termed Qualified Business Income (“QBI”). In the end, those that would normally be taxed at the new highest marginal rate of 37% may pay at a top rate of 29.6% (80% of their rate). The chart below, from www.Kictes.com, illustrates the lower Pass-Through rate at different income levels.

As you might expect, the devil is always in the details. Do all Pass-Through entities receive said benefits? What exactly is considered Qualified Business Income? In addition, will the provisions truly be “permanent” to name a few. To further complicate the issue, the actual deduction will be claimed on the business owner’s personal tax return and not as an above the line deduction or itemized deduction. Essentially, the affect is that it will not lower Adjusted Gross Income (which can have an effect on taxation of social security, Medicare premiums, and deductibility of some itemized deductions). On the plus side, this method of reporting will not affect the ability to take the new increased standard deduction if that is of greater value than your itemized deductions.

Ok, what is the big deal? Paraphrasing commentator Michael Kitces, “for the first time ever, self-employed individuals (either as sole proprietors or as owners of partnerships, LLCs, or S corporations) will have a lower tax rate than employees doing substantively similar work, thanks to the 20% QBI deduction.”

Switch to Independent Contractor status? Proceed with Caution

As you might imagine, the new rules contemplate and try to prevent owners from simply reclassifying their income or wages to benefit from the 20% deduction. Much like under current rules covering social security taxes, “reasonable compensation” to an S corporation owner does not qualify for the 20% deduction. Additionally, there are other limits that are beyond the scope of this article designed to reduce the 20% deduction that generally come into play once the owner’s taxable income exceeds $157,500 for individuals or $315,000 for married couples and become totally phased out at $207,500 and $415,000 respectively.

A special note to our Medical, Legal, Accounting, and Consulting Clients:

Your lobbying groups were not as effective as those representing engineers and architects! The TCJA defines your business as a “specific service trade or business” and special rules apply that essentially limit or eliminate a Qualified Business Income Deduction. By the way, this also includes financial services practices such as ours. The law is designed to exclude “any other trade or business where the principal asset of the business is the reputation or skill of 1 or more of its employees.” As a result, some commentators have opined that large service business may consider converting to a C corporation as the top corporate rate is now 21%.

How are specific service trade or businesses affected? If you are a specified service business and your taxable income exceed the thresholds described above ($207,500 for individuals and $415,000 for married couples filing jointly), then you lose the deduction completely. This means you are subject to the old pass-through rules and therefore pay tax at your individual tax rate.

We hope that you enjoyed our early take on the changes that will likely affect businesses and specifically Pass-Through entities. While tax simplification it is not, many business owners should experience a net gain. We will continue to monitor the tax landscape, including any Technical Corrections to the legislation and look forward to working with you in 2018.

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc.® and is a contributor to national media and publications such as Forbes and The Wall Street Journal and has appeared on Good Morning America Weekend Edition and WDIV Channel 4. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), mentored many CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Timothy Wyman and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Prior to making an investment decision, please consult with your financial advisor about your individual situation.