What is a Health Savings Account (HSA)?

A health savings account, or HSA, is a type of account that can be created for the purpose of paying certain medical expenses in a tax-efficient manner. To be eligible to contribute to an HSA, you must be covered by a qualified high deductible health insurance plan.

What are the advantages of using an HSA?

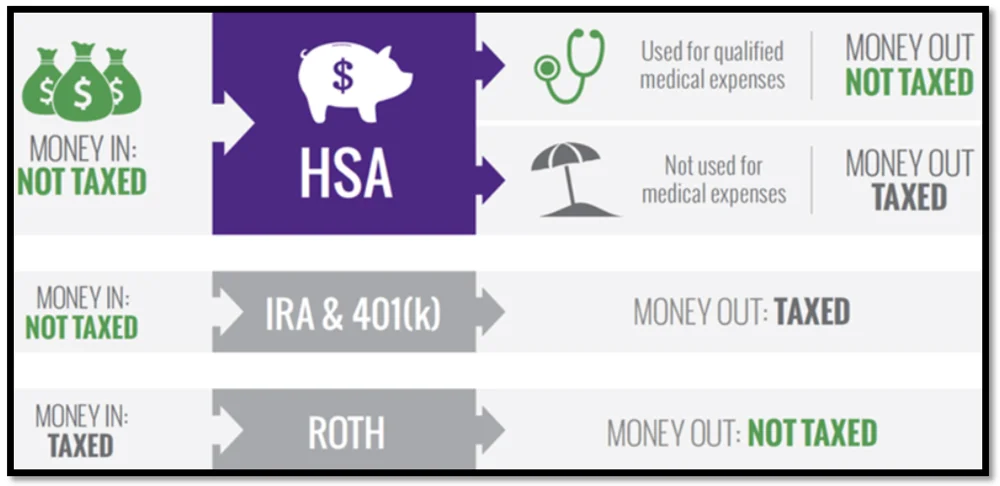

HSAs, when used properly, are tax advantaged vehicles for paying qualified medical expenses. Contributions to HSAs are tax-deductible and grow tax deferred (like an IRA). If the funds are used to pay for qualified medical expenses, distributions are tax-free (like a Roth IRA). Unlike a flexible spending account (FSA), the funds are not “use it or lose it”. Meaning, if dollars are left unused at year-end, the funds remain in your account for future use. The ‘triple tax savings’ of an HSA (deductible contributions, tax deferred growth, and tax free withdrawals) is unique to HSA plans:

How much can I contribute?

Contribution limits can change from year to year, www.IRS.gov publishes these changes as soon as they’re available. An important item to be aware of – you are no longer eligible to contribute to an HSA once you turn 65. Please see the helpful chart below that outlines contribution limits and deductible requirements for HSAs:

Typically you can invest an HSA in one of three ways: interest bearing account, Money Market Account, or a Mutual fund account. There are different risks involved with each type of investment, as always, you consult your financial advisor for help choosing the account that works best for you.

How are HSA accounts invested?

What if I withdraw funds for uses other than medical expenses?

If you make a withdrawal that is considered “non-qualified”, you will be subject to taxes and a 20% penalty on the amount you withdraw. As always, you should consult with your financial advisor, tax professional, or health account specialist to verify which expenses are considered "qualified medical expenses" (see link #1 below). It’s also important to note, you may use HSA funds to pay directly for certain insurance premiums; like Medicare, long-term care, COBRA insurance premiums.

What if I never need to use these funds for medical expenses?

Although the list of qualified medical expenses is quite extensive, if you have funds leftover after retirement that you haven’t used, a beneficial rule is in place. If you have attained age 65, you are able to withdraw funds from your HSA for any reason and avoid the 20% penalty – even if the dollars aren’t used for medical expenses.

Similar to a Traditional IRA or 401(k), however, distributions from the HSA would be taxable. This presents a great opportunity for clients who have already contributed the maximum amount to their 401(k) or IRA plans for the year, to defer additional dollars into an HAS. Doing so would allow one to reduce their current tax liability and save for future medical expenses in a tax-efficient manner.

Some clients may even elect to accumulate dollars within their HSA plan and pay for medical expenses outside of the account. The goal of this strategy is to preserve and grow the HSA balance as much as possible to take full advantage of its “triple tax advantage” attribute for medical expenses in retirement.

Links are being provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.