Are you a Financial Planner seeking a retirement succession plan?

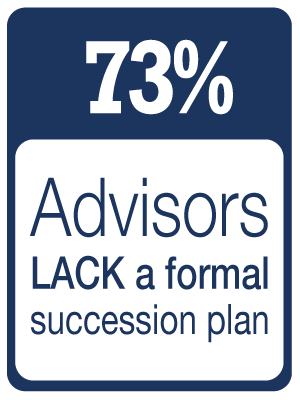

73% of advisors lack a formal succession plan, even though more than one third of advisors are planning to exit the profession over the next 10 years according to a 2018 study by the Financial Planning Association and Janus Henderson Investors.

If you are seeking to align with a financial planning team as part of your retirement transition plan, please read more about The Center to see if we could be a good fit for you and your clients.

In The News

Succession Planning In An Evolving World

A successful succession plan achieves a triple win for clients, retiring advisors, and current firm leaders. The journey has not been easy and requires a significant investment of time and money, but the effort has been well worth it.

Angela Palacios of Center for Financial Planning is quoted in this article on advancing one's career as a financial advisor. She says that joining a firm that has a career path is important. At The Center, for example, we have a clear professional development path with guidelines for how our team members can progress from entry-level to partner.

Advisors Struggle To Reopen Offices

Lauren Adams, Director of Operations, is quoted in this article on re-opening offices on how The Center has taken advantage of this time to complete renovations that will help the firm move forward after the pandemic.

5 Humble Suggestions On Transitioning Clients To Junior Advisors

Nick Defenthaler offers advice to older advisors on how to transition clients to younger advisors. Client transitions are no easy task. Spending the time to map out a transition plan is critical. The Center can help develop a succession plan for making a smooth transition for retiring advisors.

Creating An Intentional Path To Partnership Can Produce Lasting Benefits

The experience for clients and team members of the firm is directly tied to the health and effectiveness of the partner group — at least that’s been our experience in our multi‐partner advisory firm of 35 years. Managing partner Tim Wyman explains how we did it.

Our Managing Partner explains more below:

Check out the time stamps below to listen to the topics you’re most interested in:

(03:10): The importance of Core Values

(09:25): Continuity vs. succession planning and industry changes

(17:00): Founding partners and successful retirement

(19:20): What’s your catastrophic plan?

(23:20): The Center today

(24:20): Succession options

(30:55): The Center’s history of succession planning

(35:10): “Tuck-in” plans and Q&A with Peggy Hall-Davenport

(45:18): Helpful resources to consider utilizing