Co-Contributed by: Matthew E. Chope, CFP®

If you’re like most, you have multiple retirement plans from previous employers. These may be hard to track and lead to piles of paper statements. Recent rulings make it easier to consolidate accounts and potentially save on fees.

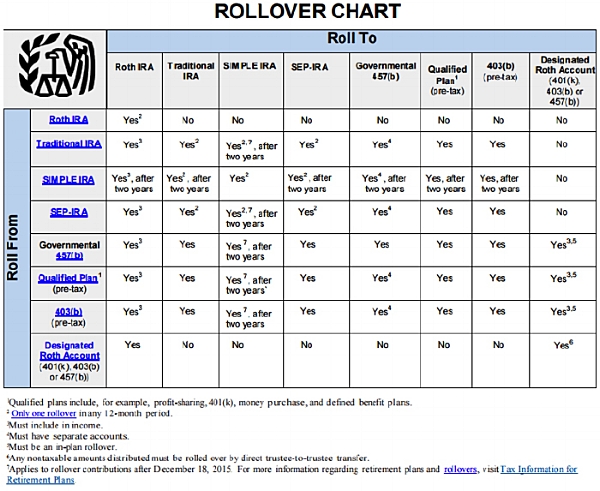

Recent changes in rulings now allow most retirement plans to be “rolled over” to other qualified plans that previously were not allowed including Simple IRAs and 401ks. One exception is you must hold your Simple IRA for two years before funds can be moved in or out of the account without paying tax penalties. Pictured is a chart showing permissible roll over types.

Things to consider before acting:

Compare investment offerings and fees for each account to find the best choice to roll into. These are usually located on your statement or in the prospectus. You can also call the phone number on your statement to inquire.

Consider consulting a financial advisor to get the best overall financial picture.

Funds must be withdrawn and redeposited within 60 days to avoid paying tax penalties.

If you have questions on how to get started, or want to talk with a professional on what your rollover options our, please reach out to your CERTIFIED FINANCIAL PLANNER™ here at The Center.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc.® Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions.

Gerri Harmer is a Client Service Manager at Center for Financial Planning, Inc.®

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Be sure to consider all of your available options and the applicable fees and features of each option before moving your retirement assets. Tax matters should be discussed with an appropriate tax professional.