Social Security

For most people, Social Security is one of their most significant income sources during retirement. Don’t file until you understand all of the options and how they affect your Social Security benefits!

Social Security Enrollment Guide:

Social Security Enrollment Guide: This guide will walk you through the steps to enroll, provide some tips, and help you collect the money you’ve earned!

Additional Resources:

Blog: Social Security is probably top of mind for a lot of you reading. We understand it can be complicated, and that’s why we’re here…

Social Security Estimator: The Retirement Estimator gives estimates based on your actual Social Security earnings record. Please keep in mind that these are just estimates.

Frequently Asked Questions:

What is Social Security?

Social Security is a federal government program officially named the Old Age, Survivors, and Disability Insurance Program (OASDI). The program provides benefits to retirees, disabled persons, and their survivors with the purpose of partially replacing lost income due to old age, death of a spouse or qualifying ex-spouse, or disability. These benefit payments, which are based on your 35 highest earning years, are funded through payroll taxes collected by the federal government through FICA taxes. The first Social Security retirement check was issued to Ida May Fuller in 1940 – the benefit amount was $22.54. Today, the maximum monthly benefit one could receive at Full Retirement Age is $3,822!

When can I collect (my retiree benefits)?

Qualifying individuals can begin collecting retirement benefits as early as age 62. However, the Social Security program establishes a Full Retirement Age (FRA), which is the age at which you become entitled to a full or unreduced retirement benefit – also known as your Primary Insurance Amount or PIA. If you begin taking your retirement benefits earlier than your FRA, you will receive a reduced benefit amount. If, on the other hand, you choose to delay taking benefits until after your FRA, you receive an increased benefit the longer you delay until you reach age 70.

What is my Full Retirement Age?

Under the current Social Security program, your specific full retirement age is based on your birth year. For example, individuals born from 1943 to 1954 reach FRA at age 66. For each birth year from 1955 to 1959 the FRA is increased by 2 months (1955 = age 66 and 2 months, 1956 = age 66 and 4 months, etc.). Those born in 1960 or later reach FRA at age 67.

How much do my benefits increase each year I delay?

Your Delayed Retirement Credits (DRC), the percentage that your retirement benefits increase the longer you delay taking them after full retirement age, depends on your birth year and the number of months that you delay. Individuals born in 1943 or later receive an increase of 2/3 of 1% per month. This equates to an annual (12-month) rate of increase of 8%.

How long can I delay benefits?

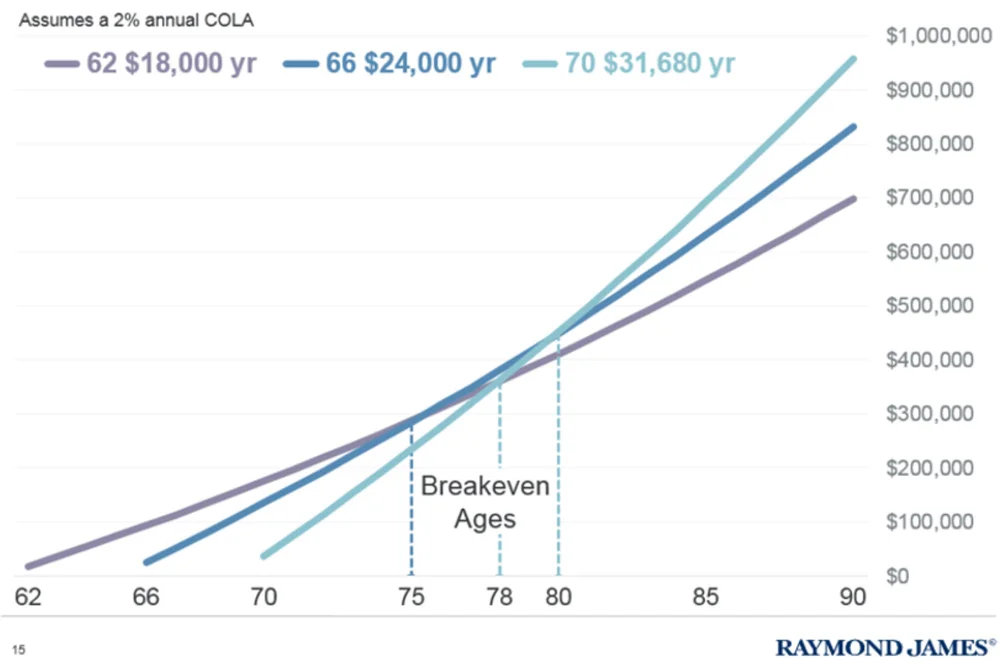

If you delay your Social Security retirement benefits beyond your full retirement age, your benefits increase by roughly 8%, up until age 70. With that being said, it would not make sense to delay Social Security beyond age 70. Conversely, each year you take benefits prior to your own Full Retirement Age (FRA), benefits will decrease by roughly 8% (an estimated 75% of Americans draw benefits prior to their FRA). While only 1% of Americans delay taking benefits until age 70, research has shown that doing so can be a great way to protect yourself from “longevity risk” in retirement – aka, living a long life in retirement. Here is a great chart that illustrates this point:

How can I see what my benefit will be and review my past earnings history?

Using the Online Retirement Estimator:

You can access your Social Security retirement benefit estimates* online using the Retirement Estimator on the Social Security Administration’s website. Access this from the homepage at www.ssa.gov.

(*Keep in mind these are estimates. The Social Security Administration cannot provide your actual retirement benefits until you apply, as the number of working years, your future earnings, and other factors may change)

Social Security Benefits Statement:

Individuals who are age 60 and over, who are not receiving benefits and who do not have a My Social Security account online with the Social Security Administration receive a paper statement each year. These statements provide estimated amounts for retirement, disability, and survivor benefits and include a summary of earnings history.

How will my Social Security benefit be taxed?

Social Security retirement, survivor, and disability benefits may be taxable to you if your income, including one-half of your Social Security income, exceeds certain thresholds. For example:

An individual filing a tax return as single that has this “combined income” between $25,000 and $34,000 may have up to 50% of his or her Social Security income as taxable

If the individual’s “combined income” is more than $34,000, then up to 85% of his or her Social Security income may be taxable.

A married couple filing a tax return jointly that has “combined income” between $32,000 and $44,000 may have up to 50% of their Social Security income as taxable.

If the individual’s “combined income” is more than $44,000, then up to 85% of their Social Security income may be taxable.

The combined income is generally equal to

Your adjusted gross income (AGI)

Tax-exempt interest (typically generated from municipal bonds)

One-half of your Social Security benefits

It is also important to note that the state of Michigan is 1 of 37 states in the United States that do NOT tax Social Security benefits.

Can I work and still collect benefits?

Yes, you can work earning an income and still collect your full Social Security retirement benefits once you reach your full retirement age (FRA). However, if you are collecting benefits prior to your full retirement age and your earned income exceeds an annual limit, you may receive a reduced benefit* during that period.

Prior to the year in which you reach your full retirement age (FRA) your benefits would be reduced $1 for every $2 you earn above an annual limit ($22,320 in 2024).

In the year that you will reach your FRA your benefits would be reduced by $1 for every $3 earned above a separate annual limit ($59,520 in 2024). Only the months before you reach your FRA count towards earnings in that year.

*Keep in mind that the reduced benefit is not a permanent reduction. Starting with the month that you reach FRA, your benefits are no longer reduced, regardless of the amount of earned income. In addition, your benefits are recalculated to account for months that you did not receive a benefit.

In most cases, collecting benefits while still working, prior to your Full Retirement Age, is not recommended. However, you should certainly consult your financial advisor to ensure this general rule of thumb applies to your own unique situation.

Can I collect based on my spouse’s benefit? How much will I receive?

You may be able to receive a Social Security benefit as a spouse (somewhere between 37.5% and 50% of your spouse’s benefit), even if you never had earned income covered by Social Security, provided that:

You’ve been married for at least one year

Your spouse is eligible for benefits and has attained age 62

Your spouse has applied for his or her own benefits

The amount of the spousal benefit depends on the ages that both spouses begin receiving benefits. Being creative with your spousal benefit filing strategy is a great way to possibly increase the total lifetime benefits both you and your spouse will receive throughout retirement.

If you qualify for your own benefits and for spousal benefits, you will be eligible for the higher of the two benefits. Social Security will pay your benefits first, and if your spousal benefit is higher than your own benefit, you receive a benefit equal to the higher spouse benefit.

What if I have my own benefit?

Can I collect based on my ex-spouse’s benefit?

If you are divorced, you can collect benefits based on your ex-spouse’s record if you meet the following criteria:

You were married at least 10 years and have been divorced for at least 2 years

You are unmarried

You are age 62 or older

The benefit you are entitled to receive under your own earnings record is less than the benefit you would receive based on your ex-spouse’s record

Believe it or not, your ex-spouse does not have to be 62, nor do they have to have filed for Social Security benefits on their own record for you to receive ex-spousal benefits.

Does Social Security increase with inflation?

Social Security benefits have an automatic annual cost of living adjustment (COLA) as measured by increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Click here to see historical COLA adjustments dating back to 1975.

Can I collect benefits as a widow or widower? What about for my kids?

Survivor benefits may be available if the deceased worker earned enough qualifying credits. The widow or widower can receive benefits:

If married for at least 9 months

At age 60 or older,

At age 50 or older if disabled, or

At any age if she or he cares for a child of the deceased who is younger than age 16 of is disabled

Children may also receive benefits if they are unmarried and are:

Younger than age 18 or up to age 19 if they are full-time students at an elementary or secondary school, or

Any age and were disabled before age 22 and continue to be disabled

To notify the Social Security Administration of a death or apply for survivor benefits you must contact a representative by telephone at (800) 772-1213 or visit your local Social Security office. As of 2018 you cannot complete these online.

How do I actually apply for my Social Security benefits?

You can apply for retirement benefits online at https://secure.ssa.gov/iClaim/rib. You can also apply by contacting a Social Security representative by telephone or by visiting your local Social Security office. In general, it’s recommended that you apply for benefits 2-3 months prior to when you actually want them to begin.

Will Social Security be around when I retire? Is it going broke?

Over the last several years, there has been lots of discussion (and some valid concern) about the state of the Social Security system. In its 2017 annual report the Social Security Board of Trustees projected that by 2022 the benefit costs (outflows) will exceed the income (revenues paid in) by increasing amounts each year and that the trust fund reserves will be depleted by 2034. A major factor in this is the aging American population who will be drawing benefits relative to the workforce that will be contributing through payroll taxes. Click here for additional discussion.

While that report seems dire, it does not suggest that Social Security will no longer pay benefits. The projections estimate that incoming revenues would be able to pay about 75% of scheduled retirement benefits. Clearly, challenges lay ahead in the coming decades to address these imbalances and allow for a sustainable system. The reality is that Social Security is still an important source of income for many retirees, not only today but in the future as well. For some for some additional insight click here. Some of the more common changes or adjustments to Social Security to help solve the funding issue include:

Removing the income cap on payroll tax for Social Security

Removing COLA adjustments on benefits

Pushing out full retirement age for those currently under age 35 by one year (would go from 67 to 68)

When should I apply for my Social Security benefits?

Deciding when to begin collecting benefits depends on many factors unique to your own situation and financial circumstances. Some of these factors may include your other sources of income, your required lifestyle and spending needs, the amount of your investment assets, whether or not you will continue to work, and your health and family medical history, just to name a few.

While there are often advantages in delaying the start of Social Security to increase your benefits each year you wait, doing some careful retirement income planning and evaluating of your options can help lead you to your own confident decision. If we can be a resource for you, please reach out to us!

Links are being provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.