Contributed by: Robert Ingram

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

The TCJA brings many changes to both corporate and individual tax laws in 2018. You may be asking yourself, “what do these changes mean for me?” A good place to start may be with the new personal income tax brackets.

How tax brackets work

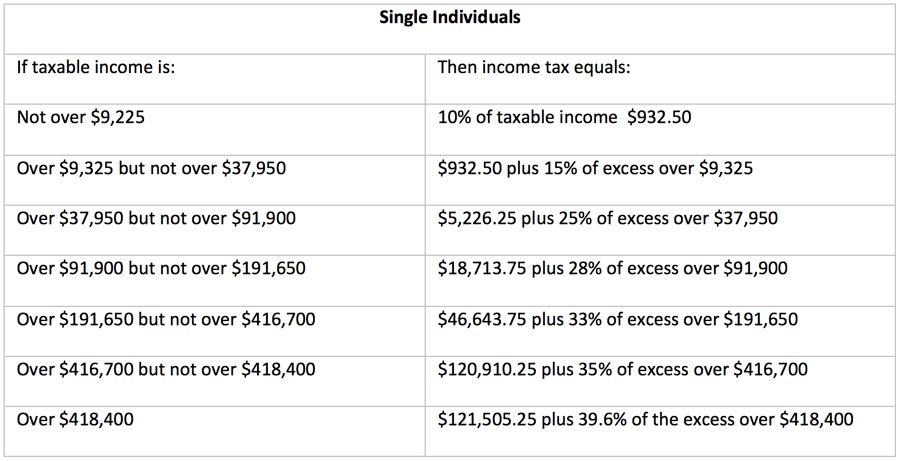

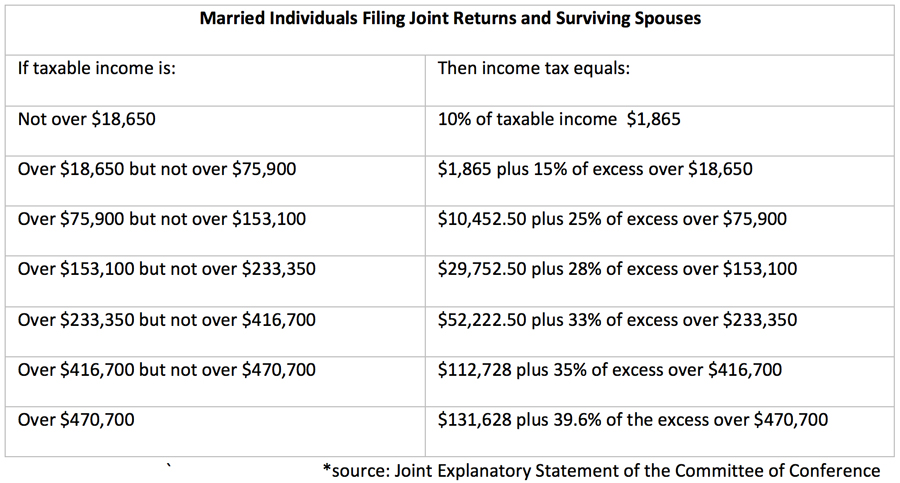

When calculating our Federal tax liability on regular income, we apply a tax rate schedule to our taxable income. The taxable income is a filer’s income after any adjustments and exclusions (adjusted gross income) and after subtracting applicable deductions and exemptions. Specific rates are then charged on different ranges of income (tax brackets) as determined by tax filing status. Currently, in 2017 there are 7 brackets where the rates are 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. The tax bracket structures and how the taxes would be assessed for two of the most common filings statuses (single and married filing joint returns) are as follows:

Current 2017 Individual & Married Tax Brackets

Under the current 2017 tax brackets, for example, a married couple filing jointly with taxable income of $150,000 would have the first portion of their income up to $18,650 taxed at 10%. The amount from $18,651 up to $75,900 would be taxed at 15% and then the remaining amount of their income from $75,901 up to the $150,000 would be taxed at 25%.

What is changing?

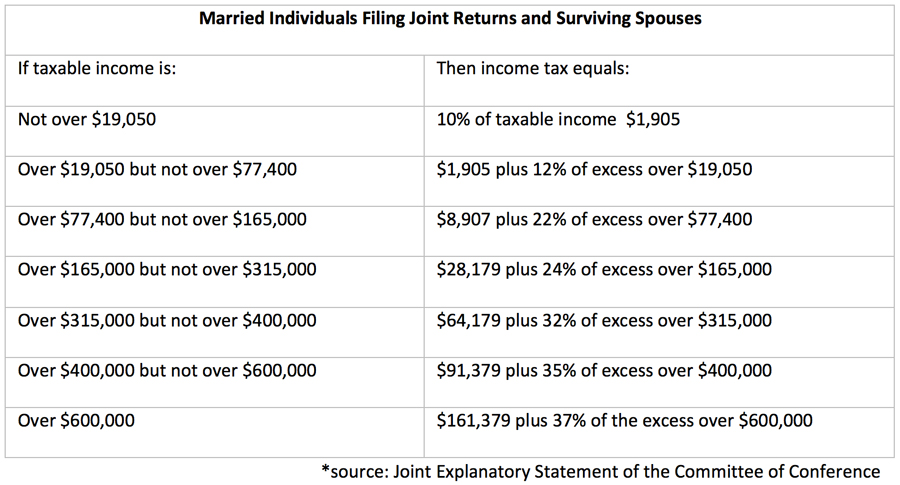

While the House of Representatives’ original tax reform proposal would have consolidated the 7 brackets down to 4, the final Tax Cuts and Jobs Act retains 7 brackets but reduces the tax rates on most the brackets by a couple of percentage points and adjusts the income ranges within them. The examples for those filing as single and for married couples filing jointly are below.

New 2018 Individual & Married Tax Brackets Under the TCJA

If the bracket rates are generally lower, does that mean my taxes will be lower?

Well, the good news is that the answer is…maybe.

If taxpayers apply the new tax rates in 2018 to the same level of taxable income they would have in 2017, many people would see a lower overall, effective tax rate on that taxable income. (Good news, right?) However, other changes outlined in the TCJA, such as the new standard deduction amount, the elimination of the personal exemptions, and the cap on the amount of state and local taxes that are deductible could have an impact on your taxable income amount. As a result, the actual taxes applied may or may not see as much of a reduction.

Ultimately, how your own tax situation may change in this new tax landscape will depend on a combination of factors and decisions. It is important to consult with your advisors. As always, if you have any questions surrounding these changes, please don’t hesitate to reach out to our team!

Robert Ingram is a Financial Planner at Center for Financial Planning, Inc.®

Check out our other Tax Reform articles:

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

This information and all sources have been deemed to be reliable but its accuracy and completeness cannot be guaranteed. Neither Raymond James Financial Services nor any Raymond James Financial Advisor renders advice on tax matters. Tax matters should be discussed with the appropriate professional.