Contributed by: Kali Hassinger, CFP®

Contributed by: Kali Hassinger, CFP®

The Social Security Administration recently announced that benefits for more than 67 million Americans would be increasing by 2.8% starting in January 2019. This cost of living adjustment (COLA for short) is the largest we've seen since 2011 when the benefits increased by 3.6%.

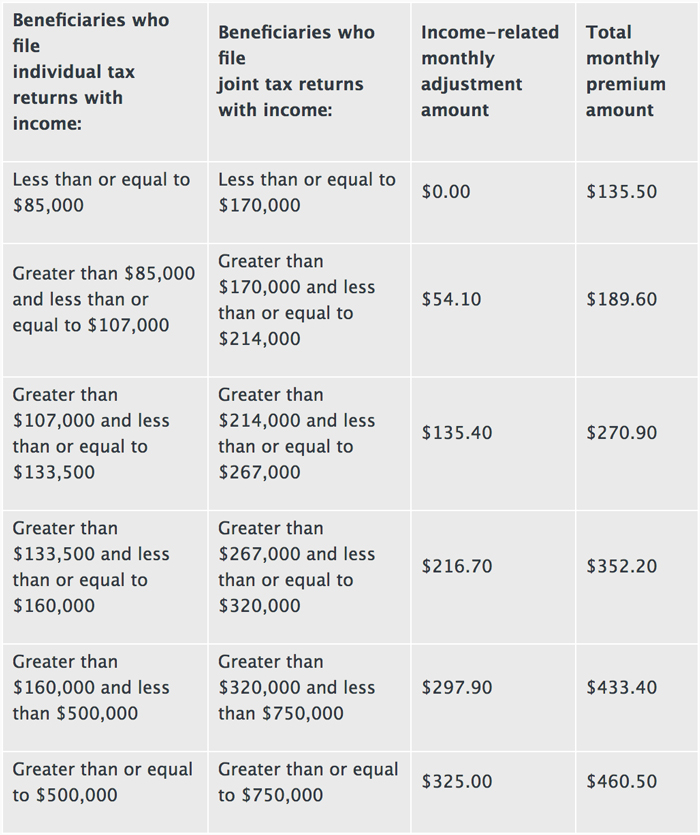

The Medicare Part B premium increase was also announced, and it will only be increased by a modest $1.50 per month (from $134 to $135.50).The premium surcharge income brackets have also seen a slight increase in the monthly premium on top of the $1.50 standard.These surcharges affect about 5% of those who have Medicare Part B.The biggest change, however, is the addition of a new premium threshold for those with income above $500,000 if filing single and $750,000 if filing jointly. This will affect:

While the Social Security checks will be higher in 2019, so will the earnings wage base you pay into if you're still working. In 2018, the first $128,400 was subject to Social Security payroll tax (6.2% for employees and 6.2% for employers). Moving into 2019 the new wage base grows by 3.5% to $132,900. Those who are earning at or above the maximum will pay $8,240 in Social Security tax each year. With the employer's portion, the maximum tax collected per worker is $16,780.

Social Security plays a vital role in almost everyone's financial plan. If you have questions about next year's COLA or anything else related to your Social Security benefit, don't hesitate to reach out to us.

Kali Hassinger, CFP® is an Associate Financial Planner at Center for Financial Planning, Inc.®

Source: https://www.cms.gov/newsroom/fact-sheets/2019-medicare-parts-b-premiums-and-deductibles