Contributed by: Center Investment Department

Monitoring investment performance is pretty important. It can help identify positive or negative investment decisions and help determine whether your investment goals are on track. For many investors, reading investment performance statements can be very confusing. Your rate of return on one statement may look different from another. The truth is that those differences can largely be attributed to the way the rate of return is calculated. There are two basic performance calculation methods: the time-weighted rate of return (TWRR) and dollar-weighted rate of return (DWRR).

Key Differences

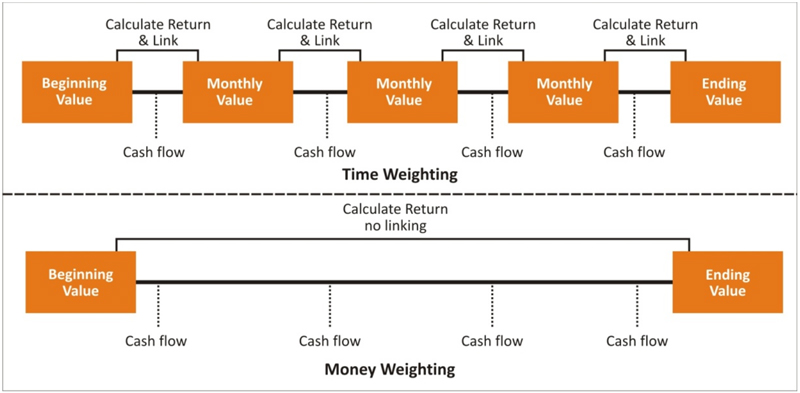

Each method is designed to measure different scenarios. The time-weighted rate of return calculation method (top of diagram) was originally developed so fund managers could measure the performance of their portfolios independent of an investor’s actions. It isolates the manager’s specific performance from investor timing of contributions and withdrawals. TWRR depends only on the length of time money has been in the portfolio and not on the size of the investment – hence the term “time-weighted.” Performance is broken down into smaller pieces when cash flows occur and then linked together so the cash flow itself doesn’t have an impact on the return calculated. This way if an investor were to make a large deposit halfway through the year, the performance of the second half of the year doesn’t hold more weight than the first half. The opposite would be true for withdrawals.

In contrast, the dollar-weighted rate of return calculation method (also referred to as money-weighted return) measures the size and timing of cash flows, in addition to the investment performance of the funds chosen by the investor. Periods in which more money is invested contribute more heavily to the overall return – hence the term “dollar-weighted.” Investors are rewarded more for larger investments made during periods of greater price appreciation or penalized less for negative returns that occur when a lower amount of money is invested. The internal rate of return is synonymous with the dollar-weighted rate of return, but the term is typically used in corporate finance to predict the rate of growth a project is expected to generate. It is the rate of return that equates the present value of costs and benefits of an investment. You often see internal rate of return calculations used for private equity investments or when determining the viability of investing in a project.

Which Method Should You Monitor?

Dollar-weighted returns can be thought of as investor-centric because they do not isolate the portfolio’s underlying performance from an investor’s luck and timing. This is what is shown on Raymond James statements because it is a more helpful representation of what the investor actually experienced during the time period.

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of professionals of the Investment Department at The Center For Financial Planning, Inc. and not necessarily those of Raymond James. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.