Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®

Our lives are constantly changing. We have in our minds what our ideal plan for our lives will be…and then life happens. According to Bruce Feller, author of “Life is in the Transitions: Mastering Change at Any Age,” on average, everyone goes through a disruptive event every 12 to 18 months. One in ten are major changes he calls “lifequakes,” which lead to transitions. More than half of them are out of our control, such as the sudden loss of a loved one or a job. We choose nearly half of them, such as moving or changing careers. Others, like a natural disaster, 9/11, or the COVID pandemic, we experience along with other people. All transitions involve us going through a process of readjusting our plans, and having the proper process in place allows us to deal with these transitions healthily.

What action steps should we take if we experience a life transition of our own?

Take a time-out. We call this the Decision Free Zone. This is an established time intentionally set aside to avoid making big decisions. When you experience a transition, you often experience shock and/or being overwhelmed, and you need time to clear the “brain fog” before any major decisions are made.

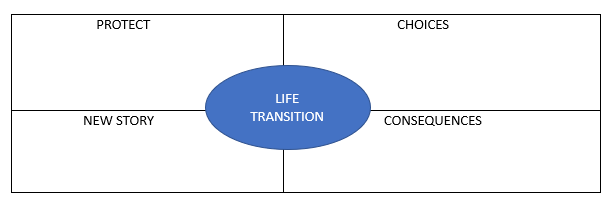

QUADRANTS

Protect: When you feel ready to start rethinking your plan based on your new circumstances, determine what needs to be protected from your project. Given the transition, are there things you save from your previous plan in the face of change?

Choices: In the face of your transition, determine what new options or alternatives you need to consider.

Consequences: Based on the various choices and alternatives, consider the consequences of each to your plan.

New Story: As you make your plan based on what you want to protect, your choices/alternatives and the consequences of each, you can picture your new plan — your new story! You can begin to imagine it in your mind and plan to make it happen. This will help you to work your way through your transition over time.

Transitions are a part of life. We are likely to have to adjust our plans many times over the course of our lifetimes. How effectively we deal with transitions will determine how successful our ultimate financial and life plans will be. If you are experiencing or anticipating a transition and would like assistance with working through the process, please reach out — we are always happy to help!

Sandra Adams, CFP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® and holds a CeFT™ designation. She specializes in Elder Care Financial Planning and serves as a trusted source for national publications, including The Wall Street Journal, Research Magazine, and Journal of Financial Planning.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services offered through Center for Financial Planning, Inc.® Center for Financial Planning, Inc.® is not a registered broker/dealer and is independent of Raymond James Financial Services.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete the CFP Board’s initial and ongoing certification requirements.

Any opinions are those of the Sandra D. Adams, CFP® and not necessarily those of Raymond James.