It doesn’t quite seem possible, but yet another summer is quickly coming to an end and before you blink, the leaves will have changed and Christmas products will be on the shelves. Very soon, school will be back in session and those who are of college age will begin the seemingly daunting task of getting their ducks in a row before another semester begins. Deep sigh……

It doesn’t quite seem possible, but yet another summer is quickly coming to an end and before you blink, the leaves will have changed and Christmas products will be on the shelves. Very soon, school will be back in session and those who are of college age will begin the seemingly daunting task of getting their ducks in a row before another semester begins. Deep sigh……

One of the top priorities on that list for parents should be to consider using a 529 account for college savings. 529 plans are tax-deferred accounts (like an IRA) that are an excellent way to save and invest for various higher educational expenses.

Features:

- Potential state tax deduction on contributions up to certain annual limits

- Tax deferred growth potential

- No taxation upon withdrawal if funds are used for qualified educational expenses (such as tuition, books, certain room and board, computers, etc.)

- The owner, generally the parents have control over the account and can transfer the account to another beneficiary

- Not subject to “kiddie tax rules,” unlike UGMA accounts (Uniform Gift of Minors Act) and UTMA accounts (Uniform Transfer to Minors Act)

Items to be aware of:

- No guaranteed rate of return – subject to market risk

- Certain taxes and penalties may apply if funds are withdrawn for non-qualified expenses

- Keep records of how money was spent that was withdrawn from the 529 account in case of an audit

- Review the asset allocation/risk profile of the account periodically. Typically, the closer the child is to entering college, the more conservative the account should become

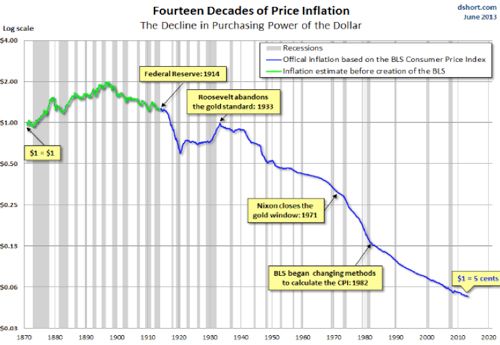

In one of our staff meetings this week, one of The Center planners reminded us all, “there are certain aspects in life that are humanly impossible to control. It is, however, the factors that we do have control over that we must focus on, to better ourselves and the service we provide to our clients.” Although college expenses have risen by almost twice the rate of inflation, this is something we truly cannot control. What we do have control over, however, are the tools we can use which can assist us in creating a solid educational financial plan – something a 529 account can help provide.

Investors should carefully consider the investment objectives, risks, charges and expenses associated with 529 college savings plans before investing. More information about 529 college savings plans is available in the issuer’s official statement, and should be read carefully before investing.

The information contained in this report does not purport to be a complete description of the subjects referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Favorable state tax treatment for investing in Section 529 college savings plans may be limited to investments made in plans offered by your home state. Investors should consult a tax advisor about any state tax consequences of an investment in a 529 plan.