Contributed by: Jaclyn Jackson, CAP®

Contributed by: Jaclyn Jackson, CAP®

Due diligence meetings are a core part of the Center’s investment research strategy. They give us a chance to vet investment strategies for our clients. They also allow us to get data from global financial institutions and industry leaders that most advisors typically don’t have the resources to aggregate themselves.

This fall, I attended the Professional Investor Forum at the Goldman Sachs Conference Center in New York. The three-day conference highlighted research from the company’s thought leaders about markets and the current economic landscape.

Here are Goldman’s views on a few questions that have been top of mind for investors.

Q: Are we facing another “Great Recession”?

Investor anxiety is reminiscent of the Great Recession, but the root of market volatility is quite different. Market volatility in 2007-2008 was triggered by unhealthy company fundamentals, particularly in the financial sector. The volatility was micro-driven.

Current market volatility is macro-driven with inflation and fed policy expectations largely dictating the investor experience. Since company fundamentals are relatively healthy, Goldman believes a recession would be shallow – especially compared to the Great Recession.

Q: What’s going on with equity markets?

Rates and higher bond yields have affected the US equity market. Today, the market trades at around 15 times forward earnings compared to 21 times forward earnings at the beginning of the year. A lot of this compression is coming from high growth companies, particularly “long-duration” tech companies where the valuation of the company is attributable to the earnings that are well into the future.

The gap between shorter-duration stocks and longer-duration stocks has been very significant in terms of the relative performance. This is a tough environment for long-duration stocks because rates will likely stay high. Companies with more nearer-term visibility on their cash flows are likely to do better in this environment. (There are tech companies with more near-term visibility, so no need to dump all tech from your portfolio.)

Inflation clarity is important because that helps us understand the direction of Federal Reserve policy and interest rate policy. Greater investor confidence about corporate earnings might be the impetus for equity volatility to decline - freeing equity prices to move higher.

Equity markets are figured out when inflation is figured out.

Q: How low can equity markets go?

Goldman Sachs expects the inflation rate to lower and for markets to recover in late 2023. This is how they see the timeline unfolding:

The Fed will be raising rates several more times this year and early part of 2023.

At the end of the year, the S&P 500 will likely close somewhere between 3,400 and 3,600, modestly down from the current level.

Markets will be down in the early part of next year until we see inflation data trending lower.

Equity market moves higher by the end of 2023.

Note, there is a case to be made for a recession. In a recessionary scenario (where the Fed hikes so much that we move into recessionary territory), Goldman believes we could hit a low of around 3,150, which is meaningfully below where we are now.

Q: When will market volatility lighten up?

Goldman Sachs Economics expects the rate of inflation (as measured by core PCE) to decelerate from close to 5 percent to roughly 3 percent. If that actually happens, they believe equity prices will do okay. Nevertheless, that won’t be clear until sometime in the middle of 2023, so uncertainty will probably continue another six months.

Q: Where should I be invested?

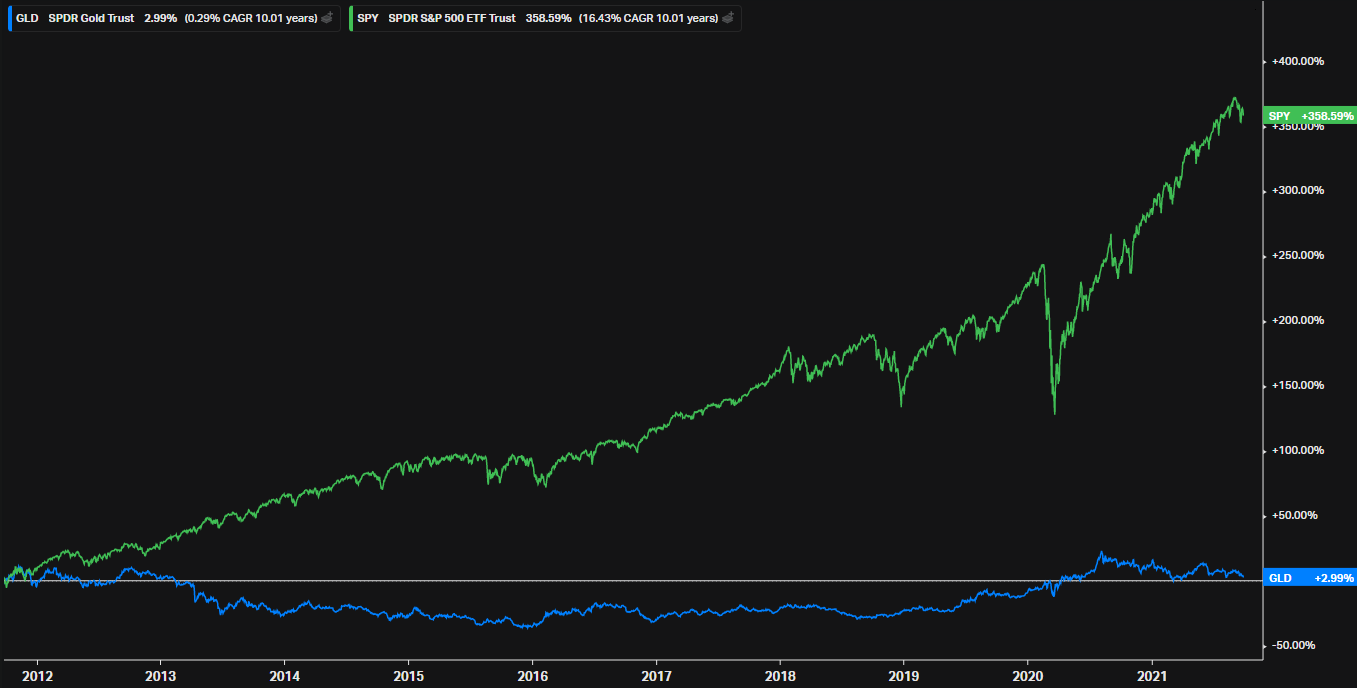

According to Goldman, we’ve move from a “there is no alternative” or TINA environment to a “there are reasonable alternatives” or TARA environment.

If investors wanted yield they would invest in equities, especially US equities. However, chasing yield through equities leaves the door open to greater risk vulnerability. With interest rates on short-term cash positions starting to approach 4 percent, investors can get an attractive rate of return from an income point of view. In the words of David Kostin, Goldman’s Chief US Equity Strategist, “the idea of pure cash returns pushing almost 4 percent and the expectation that the Fed Funds rate will be somewhere between 4.25 and 4.5 percent by the early part of next year, that would suggest that there are reasonable alternatives (to equities), just on the cash positions alone.”

To be clear, this does NOT mean one should sell all of their equities and buy short-term cash positions. Equity positions in your portfolio should generally align with your strategic allocation. This is suggesting that investors don’t have to take unwarranted risks with over-exposure to equity markets to get yield because there are reasonable alternatives (TARA). Short-term cash positions are one example of this. The key here is that now, investors don’t have to over-do-it with risks when looking for yields.

Fed tightening is a big focus, but other parts of financial conditions are tightening too - higher bond yields, wider credit spreads, stronger dollar, lower equity prices. All of these contribute to tightening financial conditions. The type of companies in the equity market that do well in this environment are companies with stronger balance sheets, companies with higher return metrics, return on equity, return on capital, companies with less drawdown in terms of their share prices, more stable growth in terms of different metrics. In short, “quality” companies are likely to help investors in the uncertain environment of tightening financial conditions.

Jaclyn Jackson, CAP® is a Senior Portfolio Manager at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

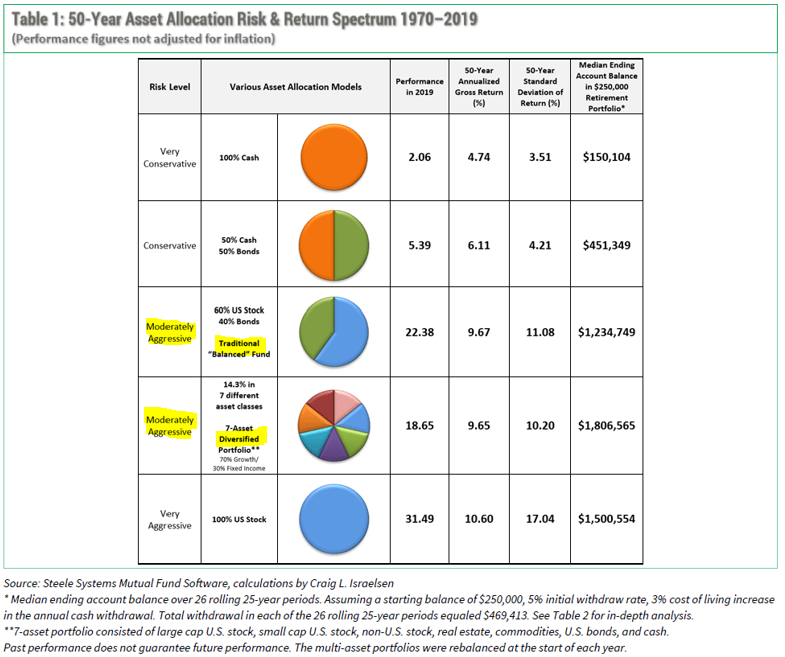

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of the author, and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Standard deviation measures the fluctuation of returns around the arithmetic average return of investment. The higher the standard deviation, the greater the variability (and thus risk) of the investment returns. Performance of hypothetical investments do not reflect transaction costs, taxes, or returns that any investor actually attained and may not reflect the true costs, including management fees, of an actual portfolio. Changes in any assumption may have a material impact on the hypothetical returns presented. Illustrations does not include fees and expenses, which would reduce returns.