Contributed by: Nicholas Boguth, CFA®, CFP®

Contributed by: Nicholas Boguth, CFA®, CFP®

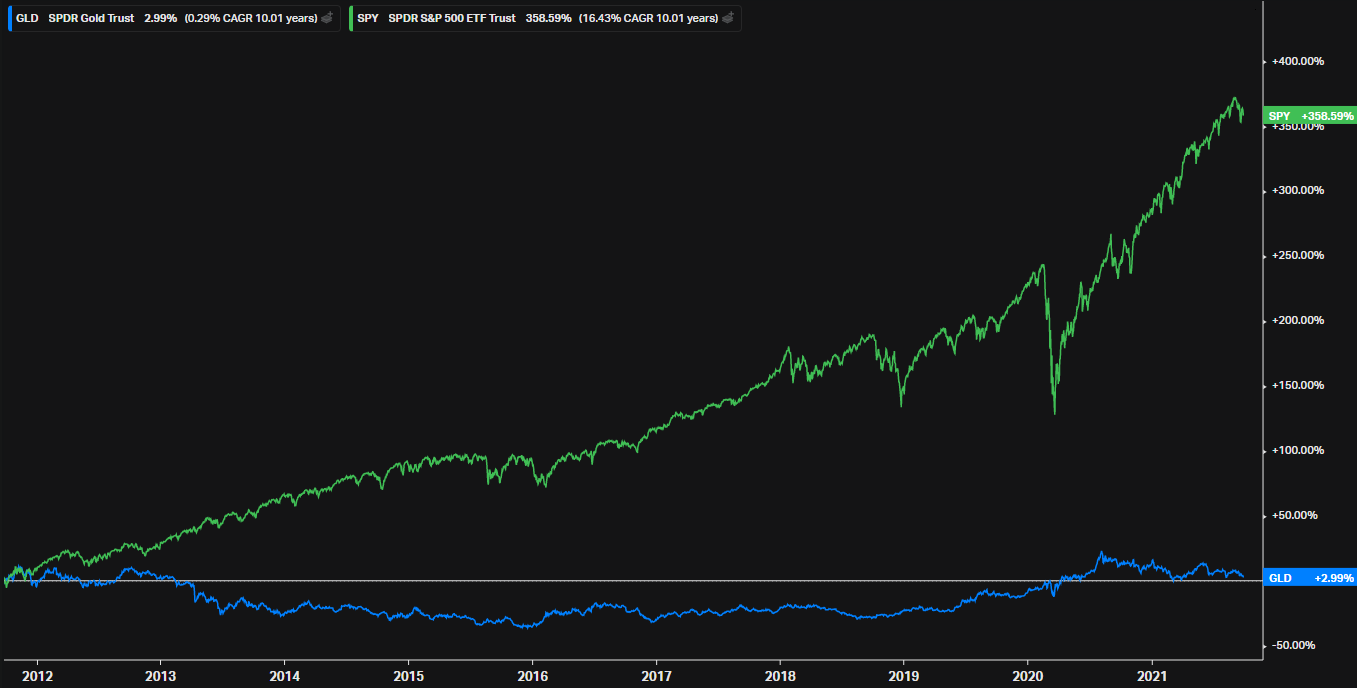

The markets can be described as cyclical, volatile, and full of booms and busts. Often those cycles seem clear as day when looking back on them through history, but they are much harder to identify in real-time. And even when most investors seem to be on the same page about what point of its cycle an investment is in, there is no telling just how far that investment can continue to climb or fall before it turns around. If many investors agree that Nvidia is in a “bubble” at ~35x price to sales, but its stock price climbs another 100%...were they right?

That cyclical nature creates an unpredictable stream of winners and losers every year, but it is important to recognize that it is just that…unpredictable. Today’s winning investments very likely could have been yesterday’s losers. Here are a few recent examples:

Energy was the worst-performing sector in 2020 (down over 30% while the market was generally positive). Then from 2021 through 2022, it ran up an incredible 150% (the next closest was healthcare at +23%)

The financial sector was the worst performer in 2011 but the best performer in 2012.

Real estate was the worst sector in 2013 but the best in 2014.

This trend has been common throughout history. Does that mean we just cracked the code? Just buy the worst-performing sector from the prior year and profit! Well, that doesn’t always work out either:

Energy was the worst-performing sector in 2019 and also the worst-performing sector in 2020.

Communications was one of the worst in 2013 and again in 2014.

Financials were the worst in 2007, and again in 2008.

The uncomfortable fact about the markets is that they are unpredictable, risky, and do not always seem to make sense at the moment, but with that risk comes reward. Trying to time market cycles is a losing game. We believe in creating an approach that positions our clients for success through every boom and bust in their lifetime. No one knows WHEN those booms or busts are coming, but we do know that they will happen sooner or later, and we want you to be prepared either way.

Nicholas Boguth, CFA®, CFP® is a Portfolio Manager at Center for Financial Planning, Inc.® He performs investment research and assists with the management of client portfolios.

The information contained in this letter does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Nick Boguth, CFA®, CFP®, and not necessarily those of Raymond James. Expression of opinion are as of this date and are subject to change without notice. There is no guarantee that these statement, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Individual investor’s results will vary. Past performance does not guarantee future results. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. Investment advisory services offered through Center for Financial Planning, Inc.® Center for Financial Planning, Inc.® is not a registered broker/dealer and is independent of Raymond James Financial Services.