The other day, one of our associates was on the phone with the Social Security Administration (SSA). When asked about the “File & Suspend” strategy, the SSA staffer said he hadn’t heard about it “yet”. Not exactly encouraging since “File & Suspend” has been around since about 2000. More than a decade later, this highly effective social security retirement benefit strategy is still considered new and obviously causing confusion.

The other day, one of our associates was on the phone with the Social Security Administration (SSA). When asked about the “File & Suspend” strategy, the SSA staffer said he hadn’t heard about it “yet”. Not exactly encouraging since “File & Suspend” has been around since about 2000. More than a decade later, this highly effective social security retirement benefit strategy is still considered new and obviously causing confusion.

To recap, this strategy is designed to help a married couple maximize their combined social security retirement benefits. One of the spouses, the higher earner, will “file & suspend” at full retirement age which allows the lower earner (or one with no earnings record) to begin receiving spousal benefits. Additionally, the higher wage earner will receive delayed retirement credits from full retirement age until the age of 70, which can have a significant impact in maximizing the couple’s combined benefits. (See Julie Hall’s October 31, 2012 blog post One Social Security Strategy Too Many Married Couples Miss).

Once a couple decides to implement this strategy

It's time to deal with the Social Security Administration.

We have not had a client file and suspend using the SSA’s online process. While this may be possible, because of the importance on getting this correct and the apparent confusion involved, we suggest visiting the SSA in person if possible. Obviously this requires more of a time commitment on your behalf, but may ensure that the application gets processed correctly. Additionally, both couples can attend together to take care of both their applications. A client recently shared their experience and stated that they were glad that they went in person. The visit took an hour and a half with their cooperative SSA staffer (even though this was the staffers first time completing a “file & suspend” request).

What needs to be communicated to the Social Security Administration at your meeting?

It is important to note that there is nothing on the application that asks if you want to suspend your benefits to earn delayed retirement credits, thus the general confusion even for SSA staffers. It is important to put a statement in the “remarks” section of the application stating, "I want to voluntary suspend all benefits in order to earn delayed retirement credits”. This is critical because voluntary suspension can only be requested if benefits have not yet been paid for the month.

What might the conversation actually sound like? Let’s use Bob and Mary Smith as an example:

Bob: “I have reached full retirement age. I would like to file for social security and suspend my benefits immediately so that I do not receive any payments and earn delayed retirement credits.”

Mary: “Once my husband Bob files and suspends his benefits, I would like to file for my spousal benefits, please,” (while using “please” may or may not help, I trust you agree that is a good thing).

Last, but certainly not least, ask to get a photocopy of the application for your own records.

Please use us a resource for all of your social security retirement needs. Social security retirement benefits can play an important role in your overall retirement success and we’d enjoy helping you maximize your benefits.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. The strategy mentioned may not be suitable for all investors. Please consult the appropriate professional regarding your individual situation.

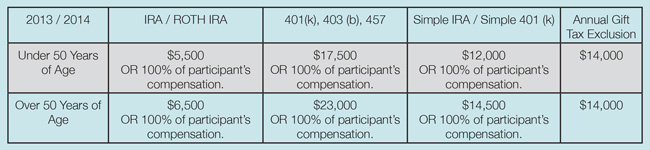

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.