Retirement planning is an exercise in imagining your future. We all posses the ability to think ahead and plan for the future; whether it is making plans for tomorrow, arrangements for a trip next year or planning ahead for retirement in 5 years, 10 years or even longer. Thinking ahead allows us to carefully arrange our financial lives to align with our future vision.

Be Ready to Adjust Your Plan

Like life, adjustments will be necessary along the way. It is more common than you may think for couples to approach retirement with an agreed upon plan, only to have divergent thoughts surface before reaching the goal. Financial planning and thoughtful conversation can help to reestablish clear direction and a workable plan to follow together. Here is a simplified case study to help illustrate crucial planning steps leading to retirement.

Try 3 Action Steps to Jumpstart Your Plan

When Jack and Sally began to think about retirement, they had more questions than answers. Sally was looking forward to relaxing and spending time in a warmer climate, while Jack couldn’t imagine moving to another state away from his volunteer work and grandchildren. This is not a unique situation. With a goal of retirement in 5 years, we established these three action steps:

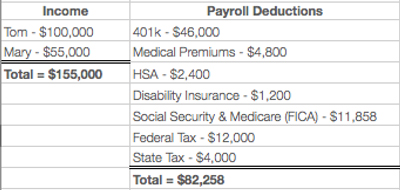

First they needed to review assets, future income sources and anticipated expenses to determine how much money they will need to live their retirement plan. Increased longevity is factored into the financial analysis.

They were in agreement to be debt free and have enough assets and income sources that cash flow would not be a limiting factor in retirement. That gave them a clear picture of how much they needed to save and invest leading up to retirement.

Jack and Sally agreed they would downsize their home to accommodate the goal of renting in a warmer climate for 5 months during the coldest part of Michigan winters.

Test your pre-retirement plan by laying out your unique objectives to see if you have a clear direction and workable plan to follow together. The most successful transitions hold the promise of retiring to something, not away from something. Contact me if you need help getting started or making adjustments along the way to your retirement goals.

Laurie Renchik, CFP®, MBA is a Partner and Senior Financial Planner at Center for Financial Planning, Inc. In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie was named to the 2013 Five Star Wealth Managers list in Detroit Hour magazine, is a member of the Leadership Oakland Alumni Association and in addition to her frequent contributions to Money Centered, she manages and is a frequent contributor to Center Connections at The Center.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

Any opinions are those of Center for Financial Planning, Inc. and not necessarily those of Raymond James. C14-034237