Contributed by: James Smiertka

Did you know you can now take advantage of the My Social Security benefits site? When you visit, you simply sign up for an account. It is a free service, and as of May 29, 2015 more than 19 million accounts have been opened.

The Benefits

If you are currently receiving benefits and/or have Medicare, you are able to:

- Get your benefit verification letter if you need proof of income, Medicare coverage, retirement status, disability, or age

- Check your benefit & payment information and view your earnings record

- Change your address and/or phone number

- Start direct deposit of your benefit or change your direct deposit info

- Get a replacement Medicare card

- Get a replacement SSA-1099 or SSA-1042S for taxes

If you do not currently receive benefits, you are able to:

- Review your Social Security Statement including estimates of your future retirement, disability, and survivor benefits

- Review your earnings once annually to verify the amounts are correct

- Review the estimated amounts of social security and Medicare taxes you have paid

- Receive a benefit verification letter if you need proof that you have never received Social security, Supplemental Security Income (SSI) or Medicare

How to Create an Account

Below is a screenshot of what you can expect to see when you visit the website:

When you select “Create an Account” you will be re-directed to the following page:

Since you are a new user, click on the blue “Create An Account” and enter your personal information:

On the following page you will confirm some information that is provided, such as your mortgage company, auto loan company, license plate, and current vehicle, etc. The confirmation of this information is used to verify your identity.

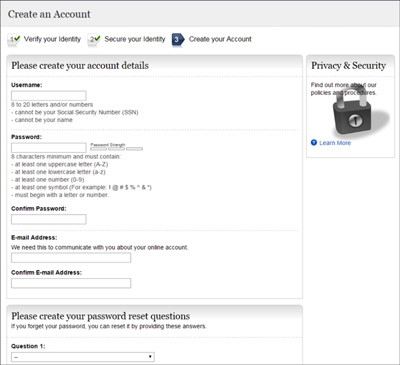

Next you will create your username & password as well as choose your password security questions:

Now you are ready to sign in to your My Social Security account. Below you’ll see an example of the information you can access when you sign in (included are the Overview & Estimated Benefits pages):

Keeping Your Information Secure

It is always important to keep your information safe and secure. Here are some important things to keep in mind:

- Emails about “My Social Security” and other government agencies always come from a “.gov” email address. Use extreme caution if the email you received is not from a “.gov” sender.

- Links, logos, & pictures will always direct you to an official Social Security website

- Examples: http://www.socialsecurity.gov/ or https://secure.ssa.gov

- Hover over a link or picture until a text box appears showing the destination address

- DO NOT respond or click any links when dealing with a phishing scam email message

- You may forward the scam email to the U.S. Computer Emergency Readiness Team at phishing-report@us-cert.gov

- Look for poor grammar, wording, phrasing, and/or spelling in all email correspondence

- Look for outlandish claims that could not possibly be true

- If a “foreign prince” emails your from overseas offering to share his gold bullion reserves in exchange for you wiring him a few hundred dollars now for safe border passage between war-torn countries, it’s probably not a legit email

- If an email includes the name of a business and/or contact information, such as telephone number or website link, you can attempt to verify the legitimacy via a search engine like Google

- Speak to friends and family members if you are questioning the validity of a strange email

- DO NOT respond with any of your personal information if you believe the email may be a scam

I hope this information will be useful for signing up and realizing the benefits of a “My Social Security” account, as well as keeping your information safe. If you have any further questions, you can utilize the www.ssa.gov website or contact your local Social Security office directly.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.