Many of you are inclined to make large charitable contributions by writing a check. If the cash is not already sitting in cash, you many need to go to your taxable investment account to determine what to liquidate to create the cash for the donation. Sure, this can provide you with an itemized deduction to potentially decrease your taxable income*, but might there be a way to make an even bigger impact on your current and future tax liability?

Many of you are inclined to make large charitable contributions by writing a check. If the cash is not already sitting in cash, you many need to go to your taxable investment account to determine what to liquidate to create the cash for the donation. Sure, this can provide you with an itemized deduction to potentially decrease your taxable income*, but might there be a way to make an even bigger impact on your current and future tax liability?

If you hold appreciated stocks or mutual funds in a taxable investment accounts, why not try to avoid paying capital gains tax when you sell to create the cash for your charitable donation? Did you know that most charitable organizations, including churches and synagogues, can accept a donation of shares of a stock or mutual fund as a gift? And did you know that in donating this way, you can avoid paying capital gains tax on a security, and so can the qualified non-profit receiving organizations?

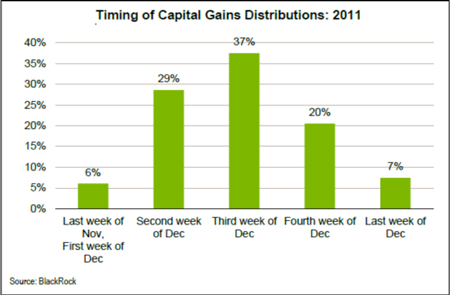

So, by using an appreciated security, not only can you avoid capital gains tax that could be significantly higher than the 15% top rate we’ve had in recent years, but you may retain the right to use the value of the security donated as an itemized deduction. Double bonus! (Triple bonus if this also allows you to tax-efficiently reduce an over-weighted position in your portfolio).

Before you write that big check to your favorite charity, consult your financial planner and tax advisor to see if opportunities exist to double your tax benefit by using appreciated securities instead.

This is how the capital gains rates look under the American Taxpayer Relief Act:

0% Capital Gains:

Those in the 15% marginal tax bracket ($36,250 single filers/$72,500 married filing jointly)

15% Capital Gains:

Those in the 25%, 28%, 33%, or 35% marginal brackets

Those over $200,000/$250,000 but below $400,000/$450,000 are subject to the Medicare surtax, which means that effectively capital gains (and qualified dividends) are taxed at 18.8%

20% Capital Gains:

Those in the 39.6% marginal bracket ($400,000/$450,000). Because of the Medicare surtax, this means that effectively, capital gains (and qualified dividends) are taxed at 23.8% (and up to 26% during the personal exemption and itemized deduction phase outs).

Sandra Adams, CFP® is a Financial Planner at Center for Financial Planning, Inc. Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In 2012 and 2013, Sandy was named to the Five Star Wealth Managers list in Detroit Hour magazine. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

*Note that the American Taxpayer Relief Act of 2012 implemented a phase out of itemized deductions for taxpayers with taxable income of over $250,000 for single filers/$300,000 married filing jointly.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of Raymond James. You should discuss any tax or legal matters with the appropriate professional.