Receiving communication that you’re subject to IRMAA and facing higher Medicare premiums is never a pleasant notification. With proper planning, however, there are strategies to potentially avoid IRMAA both now and in the future.

But first, let’s do a quick refresher on the basics

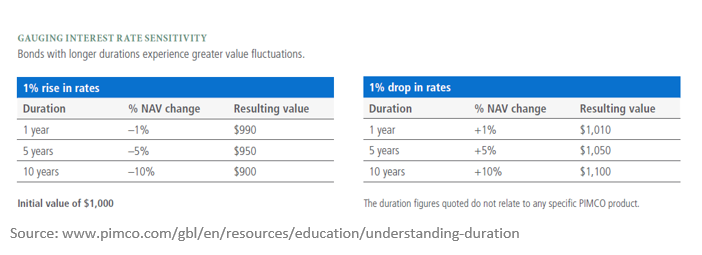

Medicare bases your premium on your latest tax return filed with the IRS. For example, when your 2023 Part B and D premiums were determined (likely occurred in October/November 2022), Medicare used your 2021 tax return to track income. If you are married and your Modified Adjusted Gross Income (MAGI) was over $194,000 in 2021 ($97,000 for single filers), you’re paying more for Part B and D premiums aka subject to IRMAA. Unlike how our tax brackets function, Medicare income thresholds are a true cliff. You could be $1 over the $194,000 threshold and that’s all it takes to increase your premiums for the year! As mentioned previously, your Part B and D premiums are based off of your Modified Adjusted Gross Income or MAGI. The calculation for MAGI is slightly different and unique from the typical Adjusted Gross Income (AGI) calculation as MAGI includes certain income “add back” items such as tax-free municipal bond interest. Simply put, while muni bond interest might function as tax-free income on your return, it does get factored into the equation when determining whether or not you’re subject to IRMAA.

Navigating IRMAA with Roth IRA conversion and portfolio income

Given our historically low tax environment, Roth IRA conversions are as popular as ever. Current tax rates are set to expire in 2026, but this could occur sooner, depending on our political landscape. When a Roth conversion occurs, a client moves money from their Traditional IRA to a Roth IRA for future tax-free growth. When the funds are converted to the Roth, a taxable event occurs, and the funds converted are considered taxable in the year the conversion takes place. Because Roth IRA conversions add to your income for the year, it’s common for the conversion to be the root cause of an IRMAA if proper planning does not occur. What makes this even trickier is the two-year lookback period. So, for clients considering Roth conversions, the magic age to begin being cognizant of the Medicare income thresholds is not at age 65 when Medicare begins, but rather age 63 because it’s that year’s tax return that will ultimately determine your Medicare premiums at age 65!

Now that there are no “do-overs” with Roth conversions (Roth conversion re-characterizations went away in 2018), our preference in most cases is to do Roth conversions in November or December for clients who are age 63 and older. By that time, we will have a clear picture of total income for the year. I can’t tell you how often we’ve seen situations where clients confidently believe their income will be a certain amount but ends up being much higher due to an unexpected income event.

Another way to navigate IRMAA is by being cognizant of income from after-tax investment/brokerage accounts. Things like capital gains, dividends, interest, etc., all factor into the MAGI calculation previously mentioned. Being intentional with the asset location of accounts can potentially help save thousands in Medicare premiums.

Ways to reduce income to potentially lower part B and D premiums

Qualified Charitable Distribution (QCD)

Contributing to a tax-deductible retirement account such as a 401k, 403b, IRA, SEP-IRA, etc.

Deferring income into another year

Accelerating business expenses to reduce income

Putting IRMAA into perspective

Higher Medicare premiums are essentially a form of additional tax, which can help us put things into perspective. For example, if a couple decides to do aggressive Roth IRA conversions to maximize the 22% tax bracket and MAGI ends up being $200,000, their federal tax bill will be approximately $30,000. This translates into an effective/average tax rate of 15% ($30,000 / $200,000). However, if you factor in the IRMAA, it will end up being about $1,700 total for the couple between the higher Part B and D premiums. This additional "tax" ends up only pushing the effective tax rate to 15.85% - less than a 1% increase! I highlight this not to trivialize a $1,700 additional cost for the year, as this is real money we're talking about here. That said, I do feel it's appropriate to zoom out a bit and maintain perspective on the big picture. If we forgo savvy planning opportunities to save a bit on Medicare premiums, we could end up costing ourselves much more down the line. However, not taking IRMAA into consideration is also a miss in our opinion. Like anything in investment and financial planning, a balanced approach is prudent when navigating IRMAA – there is never a "one size fits all" solution.

Fighting back on IRMAA

If you've received notification that your Medicare Part B and D premiums are increasing due to IRMAA, there could be ways to reverse the decision. The most common situation is when a recent retiree starts Medicare and, in the latest tax return on file with the IRS, shows a much higher income level. Retirement is one example of what Medicare would consider a "life-changing event," in which case form SSA-44 can be completed, submitted with supporting documentation, and could lead to lower premiums. Other "life-changing events" would include:

Medicare would not consider higher income in one given year due to a Roth IRA conversion or realizing a large capital gain a life-changing event that would warrant a reduction in premium. This highlights the importance of planning accordingly with these items.

If you disagree with Medicare's decision in determining your premiums, you have the ability to have a right to appeal by filing a "request for reconsideration" using form SSA-561-U2.

Conclusion

As you can see, the topic of IRMAA is enough to make anyone's head spin. To learn more, visit the Social Security Administration's website dedicated to this topic. Prudent planning around your Medicare premiums is just one example of much of the work we do for clients that extends well beyond managing investments that we believe add real value over time.

If you or someone you care about is struggling with how to put all of these pieces together to achieve a favorable outcome, we are here to help. Our team of CERTIFIED FINANCIAL PLANNER™ professionals offers a complimentary "second opinion meeting" to address your most pressing financial questions and concerns. In many cases, by the end of this 30-45 minute discussion, it will make sense to continue the conversation of possibly working together. Other times, it will not, but our team can assure you that you will hang up the phone walking away with questions answered and a plan moving forward. We look forward to the conversation!

Contributed by: Nicholas Boguth, CFA®, CFP®

Contributed by: Nicholas Boguth, CFA®, CFP®