Contributed by: Kali Hassinger, CFP®, CSRIC™

Contributed by: Kali Hassinger, CFP®, CSRIC™

Retirement planning comes with its own unique set of opportunities and challenges. When you're a single woman, deciding to retire and the many subsequent decisions surrounding that life change can feel like it presents even more anxiety. Focusing on a few key areas to optimize your financial future can help ease these doubts and ensure you make the right financial choices. Here are the top five items to plan for as you consider retirement:

1. Build and maintain a Diversified Investment Portfolio

Throughout your career, you've successfully built your retirement savings pool. When you're working and living off of your income, it can be easier to weather the market's ups and downs. When your portfolio is needed to provide income for your lifestyle and well-being, the stakes are a bit higher. Building a balanced portfolio that aligns with your risk tolerance, time horizon, and retirement goals is extremely important. With those guidelines in mind, your investment portfolio should be well-diversified across various asset classes, sectors, and geographical regions.

2. Understand your Budget, Expenses, and Lifestyle Needs

At all stages of our lives, having a budget and understanding of spending is important. When making the decision to retire, you'll want to plan for both current and future expenses. Women often have longer life expectancies than men, meaning their savings need to last longer in retirement. A detailed budget and retirement spending projection can help you determine if you've saved enough to have a financially confident retirement.

3. Create a Comprehensive Withdrawal Strategy

A well-thought-out withdrawal strategy can help preserve your portfolio and ensure it lasts throughout your lifetime. One common approach is the "bucket strategy," where you segment your savings and portfolio into different buckets or investments based on when you will need to use the money. When working with clients, we recommend keeping approximately 12 months of your portfolio income need in cash or low-risk, cash-like positions that are not subject to market volatility. Beyond that 12-month need, your ability to handle risk can vary.

Your withdrawal strategy should also incorporate and consider the tax implications of your withdrawals to avoid unforeseen tax burdens. Strategic tax planning can also help to extend the life of your portfolio.

4. Develop an Estate Plan

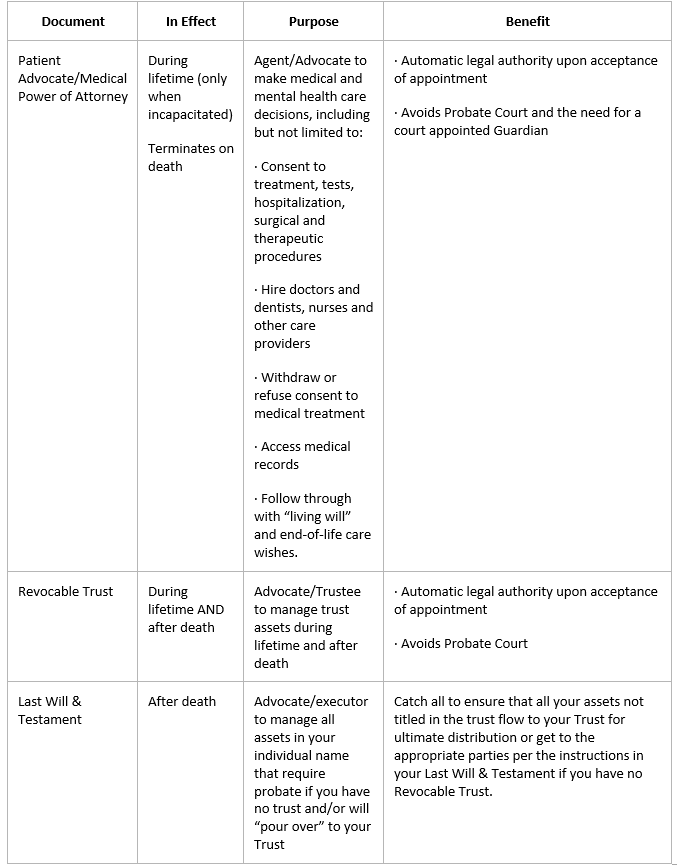

Estate planning is often overlooked, but it's one of the most critical steps in helping to ensure that your assets are distributed according to your wishes. Whether you choose family or charitable causes, deciding how your savings and possessions are handled can avoid unnecessary stress for your loved ones.

Without a spouse who would be the default decision-maker in a situation where you cannot make them yourself, it's extremely important to ensure that you've appointed a power of attorney for financial or healthcare decisions.

5. Understand your Social Security Benefits

For many, Social Security is the only fixed source of income in retirement, and the decisions are often irrevocable. As a single person, you'll want to optimize the Social Security benefits available to you. Although you can collect as early as age 62, your benefit will be higher if you collect at your full retirement age or even as late as age 70. A financial planner can help you determine the best strategy for you based on your assets, life expectancy, and retirement goals.

As retirement approaches, it's natural to feel overwhelmed by the decisions that need to be made. Working with a financial planner can provide you with the expertise and personalized advice to feel confident in your financial future. It can also provide a partner you can trust with any of life's financial decisions.

Kali Hassinger, CFP®, CSRIC® is a Financial Planning Manager and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® She has more than a decade of financial planning and insurance industry experience.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Kali Hassinger, CFP®, CSRIC™ and not necessarily those of Raymond James.

Prior to making an investment decision, please consult with your financial adviser about your individual situation. Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC. Investment advisory services offered through Center for Financial Planning, Inc®. Center for Financial Planning, Inc.® is not a registered broker/dealer and is independent of Raymond James Financial Services.