My wife truly enjoys talking to our two dogs – not that she expects them to talk back (I don’t think so at least) – but who doesn’t enjoy seeing their heads turn as if that will really help them understand what she has to say. I had a client give me a similar look a few years back when I suggested taking money from his IRA even though he didn’t need it for current spending. (The client was past age 59.5 but younger than age 70.5 so he didn’t have to take a distribution quite yet.)

My wife truly enjoys talking to our two dogs – not that she expects them to talk back (I don’t think so at least) – but who doesn’t enjoy seeing their heads turn as if that will really help them understand what she has to say. I had a client give me a similar look a few years back when I suggested taking money from his IRA even though he didn’t need it for current spending. (The client was past age 59.5 but younger than age 70.5 so he didn’t have to take a distribution quite yet.)

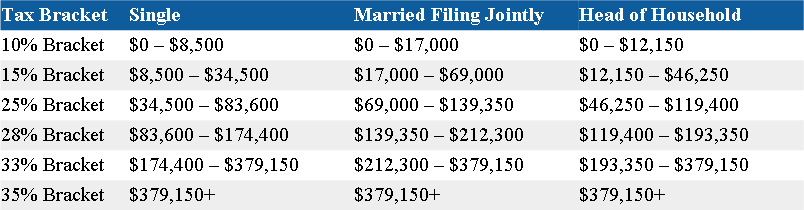

While, like my dogs, he didn’t say anything his look suggested that he was thinking “why would I take a distribution that I don’t need and accelerate income taxes?” His head started to turn straight again when I illustrated that he might want to maximize the lower tax brackets. A married couple filing jointly can have taxable income up to $69,000 in 2011 and still remain in the 15% marginal income tax bracket (remember taxable income is adjusted gross income minus exemptions and deductions). For this client, they could take out roughly $25,000 from their IRA and still be within the 15% marginal bracket. While no one knows what income tax rates will be for sure in the future –locking in a 15% rate seemed attractive.

2011 IRS Tax Brackets

To find out if accelerating IRA distributions is the right move for you, work with your financial planner and tax preparer to run “what if” scenarios.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Timothy W. Wyman, CFP®, JD, and Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Please note, changes in tax laws or regulations may occur at any time and could substantially impact your situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS we are not qualified to render advice on tax or legal matters.