I’ve got three words for you: “Diversification, Diversification, Diversification!”

I’ve got three words for you: “Diversification, Diversification, Diversification!”

Since the dawn of Modern Portfolio theory, the benefits of non-correlation with favorable impact to risk and return have created a mantra for investors. At Center for Financial Planning, we agree!

We’re not alone. As I worked on this blog, I did a quick Google search for diversification and investing. At the top of the list was a post from the SEC on “The Magic of Diversification”. Here’s an excerpt:

Source: sec.gov, Beginners Guide to Asset Allocation, Diversification, and Rebalancing

Source: sec.gov, Beginners Guide to Asset Allocation, Diversification, and Rebalancing

At this point, the mantra is ringing in your head and you’re saying, “Yes! I know this. This is a fundamental lesson for investors.”

But, wait! In 2011, diversification largely left investors begging for more. A plain vanilla, decidedly undiversified mix of the S&P 500 and Bar Cap Aggregate bond indexes outperformed a more broadly diversified mix of assets including portfolios that included international investments, small company stocks, diversified types of bonds, and commodities.[1]

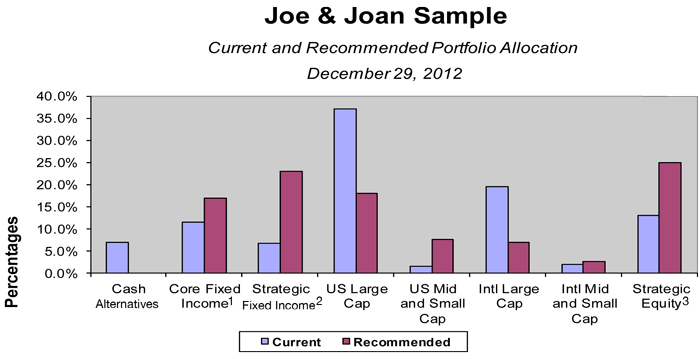

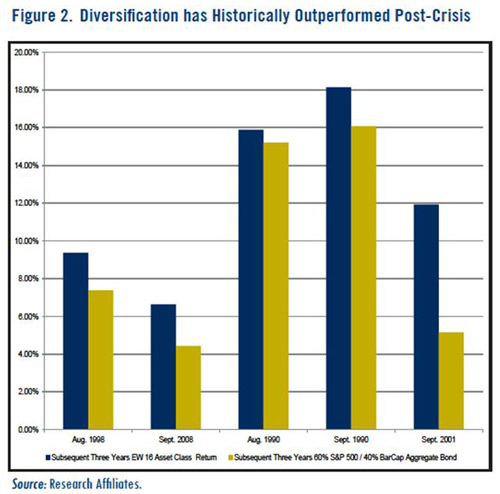

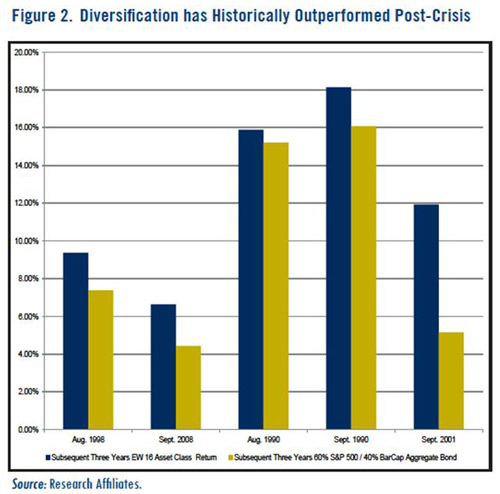

What’s an investor to do? As with anything, no investment strategy is foolproof including diversification, especially in the short run. But what your heart tells you in a period of underperformance is to stick with what’s worked recently (or bail on the mantras if they aren’t working right now). This time is different! After all, Europe looks scary! Historically, periods of diversification underperformance have been followed by outperformance. Investment thinker Robert Arnott of Research Affiliates tracks a diversified portfolio of 20 asset classes. After the 3rd quarter of 2011, the year’s worst, Arnott noted the significant underperformance of his diversified benchmark as compared to a 60/40 S&P/Bar Cap Agg portfolio.

The question for investors today is what may happen going forward. Past performance cannot predict future turns. Arnott notes, though, that in the past, following significant periods of underperformance for diversification, diversified portfolios have outperformed.

[1] Comparison of 60% S&P 500/40% Bar Cap Aggregate Bond to 30% S&P 500/10% Russell 2000/15% MSCI EAFE/5% DJ UBS Commodity/30% Bar Cap Aggregate/10% Bar Cap US Corporate Index. All index returns via Morningstar.com. Index compositions: The Barclays Capital U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The Dow Jones-UBS Commodity Index is composed of futures contracts on physical commodities and represents nineteen separate commodities traded on U.S. exchanges, with the exception of aluminum, nickel, and zinc. The Barclays Capital Corporate Bond Index is the Corporate component of the U.S. Credit index. The S&P 500 Index is a representative sample of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index ® measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The MSCI® EAFE (Europe, Australia, Far East) Net Index is recognized as the pre-eminent benchmark in the United States to measure international equity performance. It comprises 21 MSCI country indexes, representing the developed markets outside of North America. Index definitions via JP Morgan Asset Management Guide to the Markets January 2012.

Building the 3-D Shelter, Rob Arnott, October 2011

Building the 3-D Shelter, Rob Arnott, October 2011

* Diversified benchmark refers to the EW 16 Asset Class Portfolio composed of the following 16 components in equal weights: DJ UBS Commodity TR, Credit Suisse Leveraged Loan, BarCap US Corporate High Yield, BarCap US Treasury US TIPS, BofAML Convertible Bonds, FTSE NAREIT, JPM ELMI+, MSCI Emerging Markets, Russell 2000, MSCI EAFE, S&P 500, JPM EMBI, ML US Corp & Govt, BarCap US Long Credit, BarCap US Agg Bond, BarCap US Treasury Long.

Will 2012 restore your faith? Don’t count out the potential benefits of broad and divergent investments within a single portfolio. As your head bargains with your heart for patience, keep historical lessons of diversification in mind!

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Past performance may not be indicative of future results. Please note that international investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in small-cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Commodities and currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Dividends are not guaranteed and must be authorized by the company’s board of directors. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The foregoing is not a recommendation to buy or sell any individual security or any combination of securities.

Retirees love to talk about their Bucket Lists, their current adventures and travel, and all the things they would like to do before it is too late. You can have great fun constructing this checklist of what is possible, what is probable, and maybe some things that are way out there.

Retirees love to talk about their Bucket Lists, their current adventures and travel, and all the things they would like to do before it is too late. You can have great fun constructing this checklist of what is possible, what is probable, and maybe some things that are way out there.