Contributed by: Jaclyn Jackson

One of the most common ways to monitor consumer confidence and investor sentiment is to watch fund inflows and outflows. Market analysts use fund flows to measure sentiment within asset classes, sectors, or markets. This information (combined with other economic indicators) help identify trends and determine investment opportunities.

A new trend may be emerging as international fund flows are outpacing US fund flows in the second quarter. The move towards taxable bonds that began in January 2017 continued as investors have handled high U.S. stock valuations gingerly.

Asset Flows: What Investors Did This Quarter

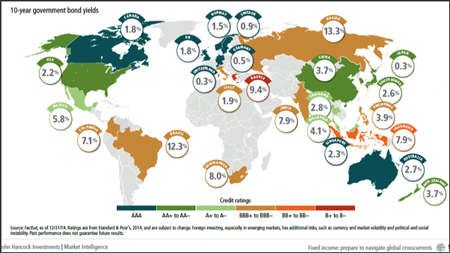

An even distribution of flows went towards taxable bonds and international equities in April. The fear of France’s exit from the European Union dissipated as Emmanuel Macron won the French presidential elections. Accordingly, flows moved into foreign large blend funds. To boot, MSCI Emerging Markets Index returns (13.9%) increased inflows to diversified emerging markets. On the other hand, first quarter GDP growth (0.7%) and political unpredictability sucked life from post-election US equity inflows.

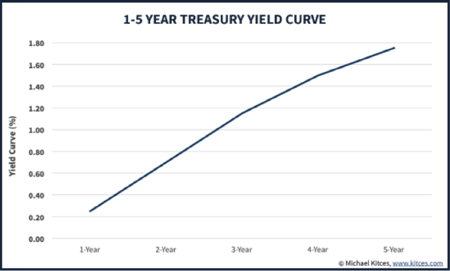

By May, US equity deceleration evolved into outflows. International equity flows remained strong. Taxable bond flows continued in spite of raised rates. Republican tax cut plans created municipals bond outflows; likely because investors don’t think federal tax exemptions will be as advantageous as they have been in the past.

Early quarter trends have continued through June. As of June 21, 2017, US equity outflows were -$1.205 billion, international equity inflows were $1.467 billion, emerging markets inflows were $0.300 billion, and taxable bond inflows were $3.016 billion.

Is the US Equity Run Over?

While the debate about the end of the US equity run ensues among industry professionals, the discussion may be mute among investors. It appears that many investors, figuring the US recovery is further along than the rest of the world, have opted to either “play it conservative” with bonds or invest internationally where there is seemly more opportunity for equity values to grow.

Jaclyn Jackson is a Portfolio Administrator and Financial Associate at Center for Financial Planning, Inc.®

This information does not purport to be a complete description of the securities, markets, or developments referred to in this material; it has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Any opinions are those of Jaclyn Jackson and are not necessarily those of Raymond James. This information is not a complete summary or statement of all available data necessary for making and investment decision and does not constitute a recommendation. Investing involves risk, investors may incur a profit or loss regardless of the strategy or strategies employed. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Asset allocation does not ensure a profit or guarantee against loss. Past performance is not a guarantee of future results. The MSCI Emerging Markets is designed to measure equity market performance in 25 emerging market indices. The index's three largest industries are materials, energy, and banks. Please note direct investment in any index is not possible.