What goes up... 2013 has been a year of extremes. The stock market[i] has produced dramatically positive total returns. Meanwhile bonds[ii] are suffering their worst losses in almost 15 years. Whether rate rise result in the advent of a new “rising rate regime” where returns have more and more headwind over time is yet to be determined. Meanwhile, stock returns have been so strong (north than 25% as of November 19th) that market watchers are increasingly debating the sustainability of continued positive returns.

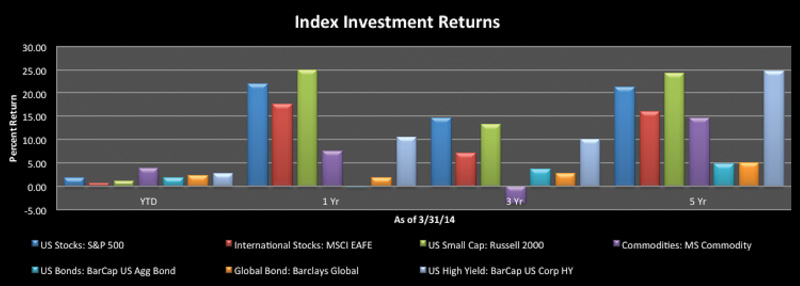

Here are full asset class returns through the 3rd quarter. Of note: we have marked the five-year anniversary of Lehman Brother’s collapse – an infamous period in American market history and also a reminder of how far portfolios and personal balance sheets have come since that time.

Economic Update

The extremity of returns is being accompanied by more unexceptional economic growth. While a desirable recovery growth rate might be 4%, the real gross domestic product was most recently measured at 2.8%[iii]. What growth there is has come without a hiring bonanza that Main Street and the Fed are craving; unemployment continues to get better but at an unimpressive pace. There are, however, quite a few bright spots in the economy.

What are the bright spots?

- Always a critical factor to economic growth, housing prices are coming off a strong year of recovery with a tight supply and rising demand. Affordability of home ownership still seems to be reasonable due to low borrowing rates for those who can qualify and rising rents. While we don’t think the high pace of recovery can be sustained, we do think the housing picture will continue to look more positive.

- Corporate profitability continues to be near historic highs. Companies, like households, did a lot of belt-tightening over the last five years. The question today is when will companies start to spend some of their cash war chest they’ve accumulated on capital expenditures or hiring?

- Surprises have come to the economy through an energy renaissance that is welcomed by US capital markets but reviled by those concerned with environmental impact of shale drilling. An underreported note is that new energy production is accompanied by continued muted demand which may be the result of slower recovery but also changes in behavior through more efficient energy usage. We will continue to keep our eyes on this development for potential positive feedback to housing and US manufacturing.

- Foreign markets have been less cheers and more jeers for much of the past few years. A recurrence of growth in Europe and introduction of new stimulus in Japan has meant that investors saw better returns[iv] in 2013. We still see attractive valuations relative to US stocks and bonds in some instances.

Valuations Today

Rather than taking a victory lap, investors are asking what’s around the corner and whether the strong returns of 2013 might be leading into a new bubble. Stock market valuations (measures of whether stocks are more or less expensive) seem to be in the fair value range – trading around a price-earnings ratio between fifteen and sixteen times[v]. We agree that what goes up may at some point come down – there has been very little pull-back in the US market this year and at some point, bigger drawdowns are probably likely.

On the plus side, much of the 2013 sequestration may be behind us, depending on the results of Washington DC negotiations on the budget and debt ceiling. Also, many have kept cash on the sidelines waiting for drawbacks to occur so they can buy at lower prices. We think this “cash on the sideline” may be part of the reason drawbacks have been so shallow this year and there is more cash where that came from. When you couple that cash with the huge pile of bonds people have purchased in the past five years with very low prospects for future return, there may be more fuel for the stock market fire.

Portfolio Construction Today

We have continued to underweight core bonds in investment portfolios, overweighting multi-sector bond diversifiers and equities in their stead. While reduced in our allocations, we feel there is an enduring role for bonds in many personal investment portfolios. We maintain a neutral weighting to US stocks, have increased our underweight in international stocks to neutral, and maintained an overweight to flexible-tactical managers who can choose between asset classes based upon the changing dynamics of markets. At all times, we recommend that you maintain a rebalancing process and invest with attention to anticipated liquidity needs, tax situations, etc.

We continue to ask you to stick with the discipline of diversified, balanced investing. In some years, you may ask us why we didn’t hunker down in cash because markets declined. At other times, you might be kicking yourself because a pure stock portfolio is up north of 25% and your diversified returns seem less impressive. Our experience leads us to recommend a broadly diversified portfolio to meet your financial goals and objectives. Thank you for your trust in letting us work with you to meet those goals.

On behalf of everyone at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

Melissa Joy, CFP®is Partner and Director of Investments at Center for Financial Planning, Inc. In 2011 and 2012, Melissa was honored by Financial Advisor magazine in the inaugural Research All Star List. In addition to her frequent contributions to Money Centered blogs, she writes frequent investment updates at The Center and is regularly quoted in national media publications including The Chicago Tribune, Investment News, and Morningstar Advisor.

Financial Advisor magazine's inaugural Research All Star List is based on job function of the person evaluated, fund selections and evaluation process used, study of rejected fund examples, and evaluation of challenges faced in the job and actions taken to overcome those challenges. Evaluations are independently conducted by Financial Advisor Magazine.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Melissa Joy, CFP® and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Investments mentioned may not be suitable for all investors. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

[i] As measured by the S&P 500 index

[ii] As measured by the BarCap Aggregate Bond Index

[iii] US Department of Commerce Bureau of Economic Analysis

[iv] As measured by MSCI EAFE NR USD

[v] Source: JPMorgan Weekly Market Recap 11/18/13