Contributed by: Angela Palacios, CFP®, AIF®

Trade wars and tariffs have dominated the headlines over the past quarter. Volatility has increased for equity markets around the world because there are fears stemming from the possibility of a trade war. To learn more about tariffs and what we think about how this could impact the markets click here.

The Federal Reserve (FED) raised rates as anticipated in March. This is the first rate hike of the year. There are two more rate hikes widely expected to come this year. Gross Domestic Product (GDP) growth has been slightly ahead of what has been expected; so, this could hint at a faster rate hike path than anticipated. Economists were expecting growth to come in at 2.7% for the 4th quarter and it came in at a revised 2.9%. Good news for the economy as we are growing faster and seem to be on solid footing. However, if the market thinks that the FED will start to raise rates faster in response to increased growth, this could negatively impact bond prices as their yields increase. Both consumer spending and business investment have been strong. Payroll taxes went down in February with the new tax reform which means we may have more money in our pockets, meaning we have the capacity, now, to spend even more.

The story is even better overseas as GDP growth has gone from mixed throughout the world (disappointing in most countries outside of the U.S. up until recently) to synchronized expansion.

Breaking a streak

The Dow Jones Industrials Average and the S&P 500 snapped an impressive nine-quarter streak of gains. This has been the longest stretch of quarterly gains for the Dow for over two decades. Prior long streaks were broken in 1997 (an 11 quarter rally for the Dow). The S&P had a more recent impressive streak that also lasted nine quarters and was broken the first quarter of 2015. Other markets including bonds and international were also down this quarter. See the chart below for more details

The cash quandary

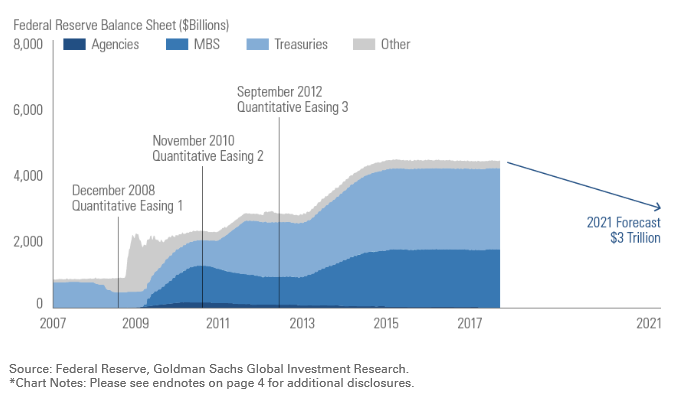

Have you noticed your money market or bank deposits rates spiking along with all of these rate hikes from the Federal Reserve? If not, you aren’t alone. Rates have continued to remain frustratingly low on our most liquid savings accounts. While the FED has raised rates by .25% on six separate occasions since 2015, deposit rates have not moved much. There are two likely reasons for this:

While the FED has raised short-term rates, long-term rates have not reacted as much. Since banks make money on the difference between the interest they charge on loans (which tend to be longer, think mortgages) and what they pay out in interest to their depositors, rates have stayed low for depositors. Banks have been unable to increase the rates they charge to loan individuals money and, therefore, they cannot raise the rates they pay on savings accounts.

Deposits at banks in small savings accounts are at an all-time high. This money tends to be steady even if the interest rate paid at the bank down the street is higher. So banks don’t have to raise the rates they pay to keep the assets. It is too much of a bother to close your account, withdraw the money, open a new account and deposit the money for a .1% boost in the interest rate.

Technology volatility

Technology stocks are catching headlines recently as Facebook had a breach of privacy and Apple and Alphabet suffer from fears of tightening regulation. The recent darlings of the stock market suffer because investors are calling in to question all of these technology companies that gather our personal data to enhance our user experience.

Midterm Elections

While it is still early in the year, midterm elections are starting to heat up. Democrats are out of power, and the midterm elections tend to favor the party that is out of power. Currently, we have a strong economy, and that is a factor that can influence whether voters go out to the polls and for whom they vote. A stable economy tends to encourage the status quo vote. The increased stock market volatility could favor the party that is out of power, though. While I’m not here to debate who will and won’t win, I am interested in how(or if) that could affect your portfolios. Generally, it isn’t a good idea to make changes within a portfolio based on politics. Politics are emotional, and it is rarely a good idea to mix these sensitive emotions with our investment dollars. We generally recommend not to make any major changes to a portfolio driven solely by an upcoming election.

In times of market distress including the areas outlined above that cause temporary volatility in markets, investors need to focus on the basics:

sticking to a diversified portfolio

maintaining appropriate cash reserves

rebalancing

If you ever have any questions on these or other topics don’t hesitate to reach out to us!

On behalf of everyone here at The Center,

Angela Palacios, CFP®, AIF®

Director of Investments

Financial Advisor

Angela Palacios, CFP®, AIF® is the Director of Investments at Center for Financial Planning, Inc.® Angela specializes in Investment and Macro economic research. She is a frequent contributor The Center blog.

https://finance.yahoo.com/news/dow-streak-quarterly-gains-risk-184351660.html https://am.jpmorgan.com/us/en/asset-management/gim/protected/adv/insights/should-i-hold-cash The information contained in this commentary does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the professionals at The Center and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Investments mentioned may not be suitable for all investors. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. The Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested, and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance, which include both U.S. and non-U.S. corporations. The IA SBBI US IT Government Bond Index is an index created by Ibbotson Associates designed to track the total return of intermediate maturity US Treasury debt securities. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.