Contributed by: Nicholas Boguth

Among the plethora of data points used to describe any security, there are two that are fundamental for a basic understanding of stocks and bonds. For equities, the two pieces of data are market capitalization (size) and investment style (value/growth). For fixed income securities, the data points are interest rate sensitivity (duration) and credit quality. These characteristics are important parts of every security’s risk/return profile, and are key in determining if and how an investment should fit in your portfolio.

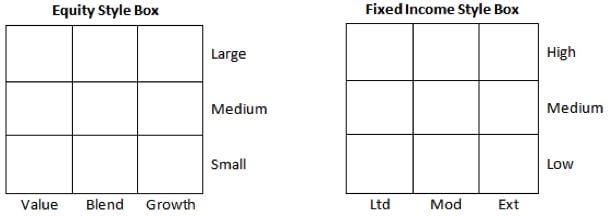

In order to help investors easily identify these two key characteristics of securities, Morningstar created a useful tool – the style box. There is a separate box for equities and fixed income securities. The equity style box shows value to growth investment styles on the horizontal axis and small to large market caps on the vertical axis. For fixed income, the horizontal axis shows limited to extensive interest rate sensitivity and the vertical axis shows low to high credit quality.

As investors, the first decision you have to make is to determine your capacity for risk. Once determined, you are able to choose investments that align with the level of risk you are willing to take. Growth stocks typically carry more risk than value stocks, and small-cap stocks are usually riskier than large-cap. Bonds can have limited to extensive interest rate risk based on duration (longer duration = more interest rate risk), and a bond with low credit quality is normally riskier than one with high credit quality. Looking at the style box, this means that a security that falls in the bottom-right square will typically bear more risk (and hopefully opportunity for more return), and a security that falls in the top left box will typically have less risk.

The style box is especially useful because not only does it indicate those fundamental data points of a single security, but you can plot all your investments on it to see the characteristics of your entire portfolio as well. Not every individual security chosen for your portfolio has to match your exact risk profile. In fact, when you build a portfolio, you may diversify and end up with securities that scatter all over the style box. The suitability of investments refers to your portfolio as a whole, not individual investments, so it is acceptable to have some lower risk and some higher risk securities. That being said, the style box does not operate on tic-tac-toe-like rules where a diversified portfolio is one with all of the boxes checked off. It does not explain everything there is to know about a diversified portfolio, but it is a very useful tool that is essential to investment basics.

Nicholas Boguth is a Client Service Associate at Center for Financial Planning, Inc.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Nick Boguth and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Diversification and asset allocation do not ensure a profit or protect against a loss. Investments mentioned may not be suitable for all investors. Past performance is not a guarantee of future results.