Contributed by: Angela Palacios, CFP®

We hit the ground running in the New Year with great insight from outside experts on a wide array of topics ranging from fixed income research to how to conduct a more successful investment committee meeting and nearly everything in between! Here is a summary of some of the highlights.

Chris Dillon, a global fixed income portfolio specialist with T. Rowe Price

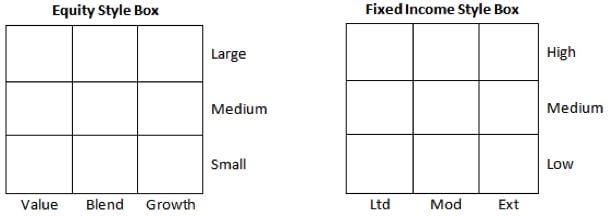

An hour spent listening to Chris was one of the most informative yet exhausting hours of the quarter! He spent much of his time explaining global complexities within the fixed income markets and how they could affect investors in the coming months. Of particular interest was a discussion on negative rates and his opinion that we will likely look back on these negative interest rate policies around the world as being completely ineffective. Also discussed was the coming money market reform here in the U.S. with the formation of Prime Money Markets that will have floating pricing (Net Asset Values). While these will mostly affect institutional level investors his recommendation was not to purchase these, but they could create a fundamental change in the market place presenting interesting opportunities for short term bond investors.

Bob Collie, Chief Research strategist, Americas Institutional, Russell Investments

Bob discussed the difficulty of working in committees as it isn’t something that comes naturally to most people. He offered many questions to ask ourselves to understand how our own investment committee measures up to others. These answers helped identify areas to focus on improving. Since our investment committee meets at least once a month you can imagine the agendas are usually very packed. We need to make the most of our time together overseeing portfolios. Areas we are focusing on improving after listening to Bob have been visioning (what does success of committee work look like), dynamic discussions, and pre-reading of agenda items and background research so we all have time to formulate our points for the discussion ahead of time. We have already noted improvements during the meeting and outcomes from the meetings. Hopefully even more improvements are on the horizon!

Jeremy Siegel, Ph.D., Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania and Senior Investment Strategy Advisor, Wisdom Tree

"Bubble, the most overused word in finance today."

He believes the market has an aggregation bias, if there are a few stocks or a sector that has large losses, like energy does now, the entire market can look skewed. The energy sector is biasing the P-E index of the market upward making it look more expensive as a whole than it really is. He thinks fundamentals have driven interest rates to zero rather than artificial means, the FED has simply followed suit reducing interest rates along the way. Economic growth and risk aversion are the most important determinants of real rates. Increased risk aversion, aging investors, a desire for liquidity and the de-risking of pension funds has increased demand for bonds forcing their yields lower. Jeremy has always had a very bullish view on the markets and now seemed no different. He feels returns over the coming years will fall in line with long term averages.

Angela Palacios, CFP® is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well as investment updates at The Center.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of Angela Palacios and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Raymond James is not affiliated with and does not endorse the opinions or services of Chris Dillon, Bob Collie, Jeremy Siegel or the companies/organizations they represent. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Past performance is not a guarantee of future results. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.