Sunday, August 14th, marks National Financial Awareness Day. For many, unless you decide to focus on finances at some point in your life or you're already working with a professional, you may be left unsure whether you're making the right decisions and progressing toward financial independence. The good news is that a few steps can be taken to help you get on a sound financial path.

Tip #1: Make a budget. And stick to it.

This is one of the most challenging steps for many to accomplish. There are things we need to pay for like housing, food, insurance, gas, and utility bills, and then there are unessential, discretionary items like clothes, concerts, and going out for dinner and drinks. Therefore, it's important to track your spending. How much of your overall budget goes toward the essentials each month? How much are discretionary or lifestyle expenses? If there are areas within the discretionary bucket that can be reduced and could ultimately be allocated toward additional savings, commit to making that adjustment. Budgeting is the foundation of getting ahead financially and progressing toward your goals.

It's also a good idea to look at your net income. Subtract out your fixed and essential expenses, and then allocate the leftover money towards savings goals and discretionary spending. Consider an online budgeting tool or app to help you achieve this.

Tip #2: Save.

Sure this seems obvious, but it's common to feel unsure of how much to save and whether you're saving enough. Saving depends on your age and the amount you've accumulated so far. It also depends on how much you plan to spend in retirement or what your upcoming financial goals require. If your employer has a retirement plan in place, it's important to contribute at least enough to take advantage of the employer match.

Many would suggest that you should always try to contribute the maximum amount allowed into your employer's retirement plans. When you consider current and future tax rates, timeline to retirement, and savings balances today, it gets more complicated. If you're later in your career and have accumulated a good balance, you may have the flexibility to reduce your savings rate and possibly your income. If you're behind and need to catch up, pushing yourself out of your comfort zone and saving aggressively may be necessary. If you're just venturing into the workforce, your income may be lower now than in the future. In this example, you may want to work in Roth IRA or 401k savings instead of tax-deferred vehicles.

Saving rates are personal. Life is about balance and saving the amount right for you, your family, and your goals.

Tip #3: Invest.

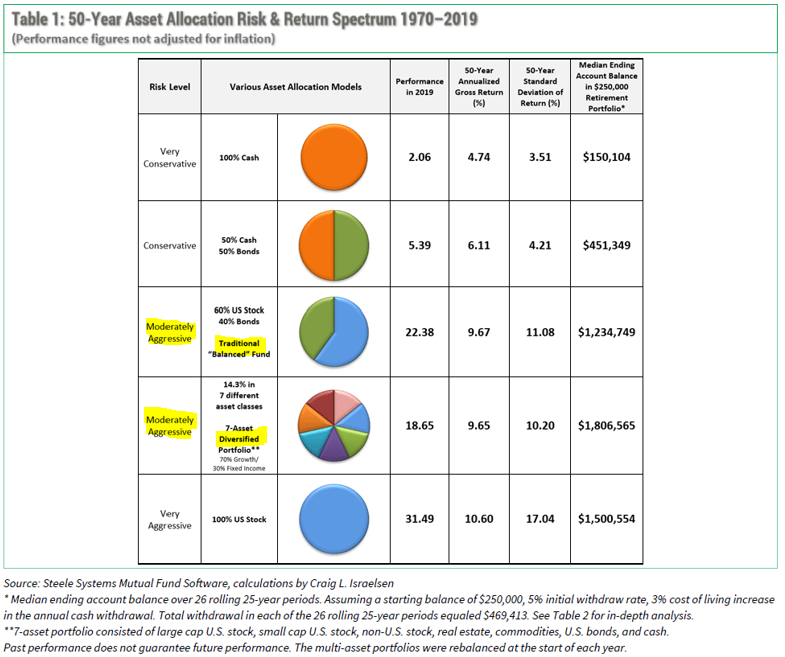

But only take on the amount of risk that you can afford. Determining the appropriate blend of stock, bonds, and cash is essential to both growing and preserving wealth. In recent years of stock market growth, picking a lemon of an investment has been challenging. 2022, however, has reminded us of the importance of diversification and your overall allocation mix. If you have an investment strategy in place, now is not the time to abandon that plan. High inflation, rising interest rates, and international turmoil have created a volatile environment, but it can also create opportunities. If you have yet to invest, there's no better time than now to get a plan in place.

If the idea of investing seems foreign, I suggest you review our Investor Basics blog series that our outstanding investment department provided a few years ago:

Tip #4: Understand your credit score.

For a number that's so important to our ability to buy a home, purchase a car, or rent an apartment, credit scores can feel mysterious and sometimes frustrating. In reality, a formula is used to determine our credit score, and five main factors are considered.

35% Payment History: Payment history is one of the most significant components of your credit score. Have you paid your bills in the past? Did you pay them on time?

30% Amounts Owed: Just owing money doesn't necessarily mean you are a high-risk borrower. However, having a high percentage of your available credit used will negatively affect your credit score.

15% Length of Credit History: Generally, having a longer credit history will increase your overall score (assuming other aspects look good). However, even people with a short credit history can still have a good score if they aren't maxing out their credit card and are paying bills on time.

10% New Credit Opened: Opening several lines of credit in a short period almost always adversely affects your score. The impact is even greater for people that don't have a long credit history. Opening multiple lines of credit is generally viewed as high-risk behavior.

10% Types of Credit You Have: A FICO score will consider retail account credit (i.e., Macy's card), installment loans, mortgage loans, and traditional credit cards (Visa/ MasterCard, etc.). So, having credit cards and installment loans with a good payment history will raise your credit score.

It's important to manage your debt balance, only take out credit when necessary, and pay your bills on time. If you already have credit cards, student loans, and/or personal loans, try to pay off balances with higher interest rates to keep them from becoming unmanageable. Some people find it easier to pay off a smaller balance first, giving them a sense of progress and accomplishment. This is a more than acceptable start to proper debt management.

Tip #5: Work with a Professional.

There's no better time than now to build the foundation for financial security and independence. Working with a professional can help you answer questions and address the unknowns. By making smart decisions now, you're positioning yourself for future success. Use these helpful tips, and keep progressing toward the ultimate goal of a worry-free, financial future and retirement.

Feel free to contact your team here at The Center with any questions. Take control now, and you'll rule your finances – not the other way around!

Contributed by: Nicholas Boguth, CFA®

Contributed by: Nicholas Boguth, CFA®