Back in May 2012, Ford Motor Company announced plans to offer pension lump sum buy out payments to 90,000 retirees (see my blog). Not to be outdone, General Motors announced a similar program shortly thereafter (see my blog). As our firm began to see many in the financial services industry swarm to get a piece of the lump sum money pie …. we issued a Consumer Alert to retirees faced with the lump sum decision (see our blog here).

Back in May 2012, Ford Motor Company announced plans to offer pension lump sum buy out payments to 90,000 retirees (see my blog). Not to be outdone, General Motors announced a similar program shortly thereafter (see my blog). As our firm began to see many in the financial services industry swarm to get a piece of the lump sum money pie …. we issued a Consumer Alert to retirees faced with the lump sum decision (see our blog here).

Since these early writings, we have consulted with several retirees to assist in making an appropriate decision based upon their unique circumstances. Moreover, we have continued to be a resource to the local and national media.

On July 18, 2012, I shared my observations with Channel 4’s Business Editor, Rod Meloni, that there are a few financial decisions in our lives we need to get right and this is one of them, quite frankly.

Earlier this month, Melissa Joy, CFP® and I were interviewed for a story by the Dow Jones News Wire (see our blog here). The story illustrated that there are non-financial factors that should be considered in making the lump sum decision.

So, after multiple individual consultations, contributions to the media, and internal conversations with my colleagues, I share what I believe to be what really matters in making a suitable decision as it relates to continuing a monthly pension or taking a lump sum buy out:

- Life expectancy: While not the most enjoyable topic – your life expectancy as compared to the IRS life expectancy tables [the table used is a “unisex” table] is a critical factor. For example, a 65-year-old man or woman has a life expectancy of 84.14 years; a 70-year-old 85.25; and an 80-year-old 88.61. YOUR life expectancy is based on YOUR health, heredity and lifestyle. Is it longer or shorter than the IRS life expectancy? If shorter, taking the lump sum is more appropriate. If you expect it to be longer, consider continuing the monthly pension. If you know exactly when you will die, the decision is pretty straight-forward. But, assuming you don’t know that date … there will be a degree of uncertainty in the decision.

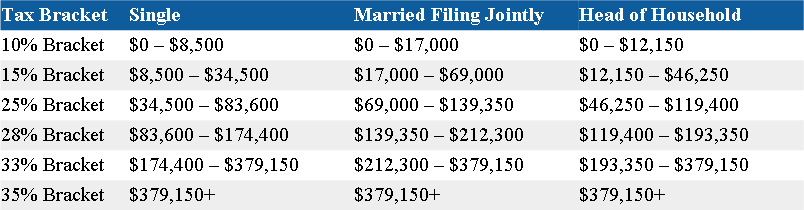

- Assumed rate of return if lump sum invested: Federal law governs what rate employers must use when computing the lump sum. The rate is a blended corporate bond rate that is based on age and may fluctuate month to month. The rate for a 65-year-old is near 4.25% and is lower for older ages. If your plan is to invest in vehicles that are expected to return less than the rate used to compute the lump sum, and you have an average life expectancy, then continuing the monthly pension makes more sense. Hypothetically, five year certificate of deposit rates are currently 1% or less. If that is your investment plan for the lump sum, it will be hard to generate more income from a lump sum so you may want to continue the monthly pension.

- Unique circumstances: What unique circumstances do you and your family have? As I shared in the Dow Jones story, even though the number crunching may suggest one decision – the non-financial decisions might just trump the numbers. Do you have the discipline to take only monthly withdrawals equal to your previous pension if you take a lump sum? Are you likely to give money away to others such as children when you really shouldn’t? Do you have a gambling or substance abuse issue? In one case, our client determined that they were likely to provide support to their kids (to their own detriment) if they had a lump sum. They therefore chose to continue the monthly pension.

Ford and GM sure have stirred up both excitement and anxiety for many retirees. While the GM Pension offers have come and gone, Ford salaried employees will be receiving offers and making these decisions going forward. The decision to continue a monthly pension or take a lump sum is an important one and one that you need to get correct. To make an appropriate decision, you need to do the number crunching and consider the non-financial aspects. Please let us know if we can help reduce some of the anxiety and assist in making a suitable decision based on your unique circumstances and goals.

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. You should discuss any tax or legal matters with the appropriate professional. Prior to making an investment decision, please consult with your financial advisory about your individual situation.