If you're self-employed or own a small business, you've probably considered establishing a retirement plan. If you've done your homework, you likely know about simplified employee pensions (SEPs) and savings incentive match plans for employees (SIMPLE) IRA plans. These plans typically appeal to small business owners because they're relatively straightforward and inexpensive to administer. What you may not know is that in many cases an individual 401(k) plan (which is also known by other names such as a solo 401(k) plan, an employer-only 401(k) plan, or a single participant 401(k) plan) may offer a better combination of benefits.

What is an individual 401(k) plan?

An individual 401(k) plan is a regular 401(k) plan combined with a profit-sharing plan. Unlike a regular 401(k) plan, however, an individual 401(k) plan can be implemented only by self-employed individuals or small business owners who have no other full-time employees (an exception applies if your full-time employee is your spouse). If you have full-time employees age 21 or older (other than your spouse) or part-time employees who work more than 1,000 hours a year, you will typically have to include them in any plan you set up, so adopting an individual 401(k) plan will not be a viable option.

What makes an individual 401(k) plan attractive?

One feature that makes an individual 401(k) plan an attractive retirement savings vehicle is that in most cases your allowable contribution to an individual 401(k) plan will be as large as or larger than you could make under most other types of retirement plans. With an individual 401(k) plan you can elect to defer up to $18,000 of your compensation to the plan for 2016 (plus catch-up contributions of up to $6,000 if you're age 50 or older), just as you could with any 401(k) plan. In addition, as with a traditional profit-sharing plan, your business can make a maximum tax-deductible contribution to the plan of up to 25% of your compensation (up to $265,000 in 2016). Since your 401(k) elective deferrals don't count toward the 25% limit, you, as an owner-employee, can defer the maximum amount of compensation under the 401(k) plan, and still contribute up to 25% of total compensation to the profit-sharing plan on your own behalf. Total plan contributions for 2016 cannot, however, exceed the lesser of $53,000 (plus any catch-up contributions) or 100% of your compensation.

For example, Dan is 35 years old and the sole owner of an incorporated business. His compensation in 2016 is $100,000. Dan sets up an individual 401(k) plan for his retirement. Under current tax law, Dan's plan account can accept a tax-deductible business contribution of $25,000 (25% of $100,000), plus a 401(k) elective deferral of $18,000. As a result, total plan contributions on Dan's behalf can reach $43,000, which falls within Dan's contribution limit of $53,000 (the lesser of $53,000 or 100% of his compensation). These contribution possibilities aren't unique to individual 401(k) plans; any business establishing a regular 401(k) plan and a profit-sharing plan could make similar contributions. But individual 401(k) plans are simpler to administer than other types of retirement plans. Since they cover only a self-employed individual or business owner and his or her spouse, individual 401(k) plans aren't subject to the often burdensome and complicated administrative rules and discrimination testing that are generally required for regular 401(k) and profit-sharing plans.

Other Advantages of an Individual 401(k) Plan

Large potential annual contributions and straightforward administrative requirements are appealing, but individual 401(k) plans also have advantages that are shared by many other types of retirement plans:

An individual 401(k) is a tax-deferred retirement plan, so you pay no income tax on plan contributions or earnings (if any) until you withdraw money from the plan. And, your business's contribution to the plan is tax deductible.

- You can, if your plan document permits, designate all or part of your elective deferrals as after-tax Roth 401(k) contributions. While Roth contributions don't provide an immediate tax savings, qualified distributions from your Roth account are entirely free from federal income tax.

- Contributions to an individual 401(k) plan are completely discretionary. You should always try to contribute as much as possible, but you have the option of reducing or even suspending plan contributions if necessary.

- An individual 401(k) plan can allow loans and may allow hardship withdrawals if necessary.

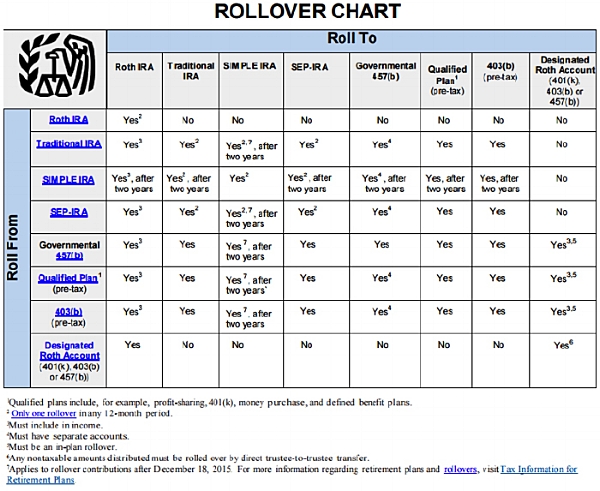

- An individual 401(k) plan can accept rollovers of funds from another retirement savings vehicle, such as an IRA, a SEP plan, or a previous employer's 401(k) plan.

Disadvantages

Despite its attractive features, an individual 401(k) plan is not the right option for everyone. Here are a few potential drawbacks:

- An individual 401(k) plan, like a regular 401(k) plan, must follow certain requirements under the Internal Revenue Code. Although these requirements are much simpler than they would be for a regular 401(k) plan with multiple participants, there is still a cost associated with establishing and administering an individual 401(k) plan.

- Your individual 401(k) plan assets are fully protected from your creditors under federal law if you declare bankruptcy. However, since an individual 401(k) plan generally isn't subject to ERISA, whether your plan's assets will be protected from your creditors outside of bankruptcy will be determined by the laws of your particular state.

- Self-employed individuals and small business owners with significant compensation can already contribute a maximum $53,000 by using a traditional profit-sharing plan or SEP plan. An individual 401(k) plan will not allow contributions to be made above this limit (an exception exists for catch-up contributions that can be made by individuals age 50 or older).

If you think an Individual 401(k) might be the right vehicle for you, we encourage you to contact your financial planner to work through your individual situation to make the right choice for you. Feel free to reach out to us if you think we can be of help!

and

and