Contributed by: Clare Lilek

Here at The Center for Financial Planning, Inc., we host webinars not only for our clients but also for other professionals who we may work with as part of the team to best serve our clients. During these webinars, our CERTIFIED FINANCIAL PLANNERS™ dive into specific topics in greater detail than you might find in a typical blog. In our latest webinar of this kind, Nick Defenthaler, CFP®, with the help of Abram Claude, Head of Value Add Programs Learning Center at Columbia Threadneedle Investments, hosted a 45 minute webinar detailing Cash Balance plans as a way to help business owners potentially accelerate retirement savings and lower taxes.

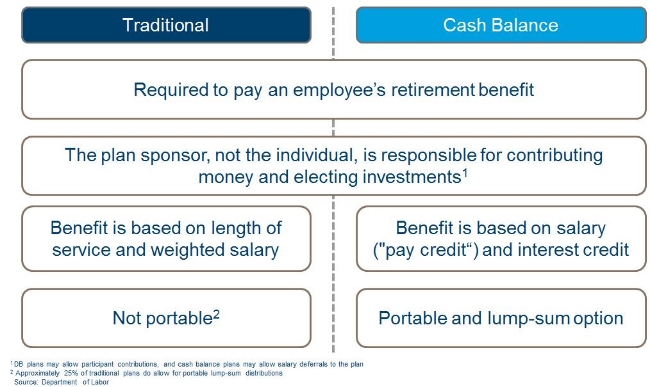

First, Abram clarified a cash balance plan as one type of defined benefit plan. He detailed the differences between a traditional defined benefit plan versus what the majority of the webinar discussed, a Cash Balance plan. Below you can reference a chart that distinguishes the two:

Typically, Cash Balance plans have been seen as an option only for larger companies, but many smaller businesses have been utilizing this retirement saving strategy because they’re usually easier to manage, they’re not as dependent on interest rate changes, and they offer the same benefit cost for the employer independent of the employee’s age or time with the company, compared to Traditional defined benefit plans.

Here are some questions to ask to determine whether or not a business might be a good fit for a Cash Balance plan:

Does the business have a consistent, profitable history?

Will the business have significant and consistent cash flow moving forward?

Does the business have a budget that can support plan contributions?

Does the business already maximize its contributions to a defined contribution plan (401k, 403b, etc.)?

Are there multiple owners or partners?

Do the business owners or partners want to accelerate their ability to save for retirement and save taxes?

Is there a low ratio of non-highly compensated employees to highly compensated employees?

Are the highly compensated employees older than the non-highly compensated employees?

Is the company relatively small in size (e.g. fewer than 20 eligible employees)

The more “yes,” responses, the greater possibility that a Cash Balance plan might be a good fit for your business or your clients!

For more information, watch the webinar below as Nick and Abram go into the details surrounding the mechanics of these plans, along with helpful examples to illustrate the potential benefits of a Cash Balance plan. If you have any questions after watching the webinar, please feel free to call the office or reach out Nick Defenthaler, CFP®, and we’d be happy to help!

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Clare Lilek and and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Raymond James is not affiliated with and does not endorse the opinions or services of Abraham Claude.

Clare Lilek is a Challenge Detroit Fellow / Client Service Associate at Center for Financial Planning, Inc.

Raymond James is not affiliated with and does not endorse the opinions or services of Abram Claude and/or Columbia Threadneedle Investments.