Recently, an article in The New York Times titled "As Gen X and Boomers Age, They Confront Living Alone" has gained widespread attention. As a financial adviser, I have noticed a trend of more clients entering and living in retirement alone over the past five to ten years. This is a topic worth considering, as the number of people living alone in retirement is increasing.

The statistics speak for themselves. According to the U.S. Census Bureau, 36% of American households are currently occupied by single individuals aged 50 and older, a total of nearly 26 million people. This group has traditionally been more likely to live alone, and now that age group, including baby boomers and Gen Xers, makes up a larger share of the population than ever before. Additionally, changing attitudes towards gender and marriage have caused individuals aged 50 and older to be more likely to be divorced, separated, or never married. One in six Americans aged 55 and older do not have children, and because women tend to live longer than men, over 60% of older adults living alone are female.

The challenges of living alone in retirement are real. Here are the top 5 challenges and how to plan for them:

1. Living alone can lead to social isolation

According to the Census Bureau, a higher proportion of older women live alone in retirement. However, men are more vulnerable to the negative effects of solitary living, such as social isolation, which can increase the risk of health issues and a higher mortality rate. Those living alone and not engaging socially may be at risk for general, mental, and cognitive health problems.

To combat the challenges of social isolation that come with living alone, it is important to make intentional plans. This is especially crucial for those who may not have children or many family members. Finding social groups to be a part of, whether in the community, through hobbies or volunteering, or with current or former colleagues, can keep you connected and engaged with the outside world.

2. Managing the home can become a challenge over time

According to a 2021 AARP study, over 90% of older adults want to continue living in their own homes during retirement. While this desire for comfort and privacy is entirely understandable, managing a home can be financially and physically overwhelming for single individuals as they age. If the home is not designed for "aging in place," it may become difficult to manage if the individual experiences health or mobility issues. To address these challenges, many single individuals may choose to:·

Pay off their home before retirement.

Make home modifications in advance to accommodate future needs.

Build flexibility into their financial plan to pay for help with managing their home once they are unable to do so themselves.

3. Single retirees living alone have no built-in partner to be their advocate for estate planning purposes

Deciding on a power of attorney for financial affairs, patient advocate, successor trustee for a trust, and executor for a will can be difficult for single older adults, especially those with no children or family. Those with no family or close friends to ask for these roles may struggle with the decision.

There are now professional advocates who can fill these roles, such as attorneys for financial power of attorney and successor trustee (or third-party financial and bank Trust departments that can serve as successor trustees), attorneys or geriatric care managers/social workers as patient advocates, and attorneys as executors. However, it is important to note that hiring professionals to serve in these roles requires advanced planning and incurs a cost.

4. Single retirees living alone have no built-in partner to care for them

According to the Department of Health and Human Services, someone turning 65 today has nearly a 70% chance of needing such long-term care in their remaining years. On average, women need care longer (3.7 years) than men (2.2 years).

For those older adults who are part of a couple, they can avoid paying for professional care longer by caring for each other for some time. Single individuals living alone will likely need to pay for care needs from day one of their needs. One way to address this challenge is to prepare well in advance for this potential need by planning for long-term care needs.

While you are still working, make sure that you have long-term disability insurance that covers the expense of potential care needs. For the costs that may occur in your retirement years, consider long-term care insurance and/or carve out a portion of your retirement savings earmarked for long-term care expenses. Have a plan for what you will do if you ever have a long-term care event, and have your plan in written form for your advocates. If you aren't able to live in your own home due to your future health, have a plan for where you might consider going and how that will be paid for.

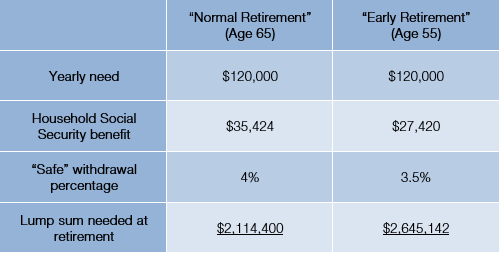

5. From a financial aspect, single retirees rely only on one set of resources and assets

Single individuals living alone are in a unique financial situation. They have only themselves to rely on for the remainder of their lives. There is no spousal Social Security or pension to be a backstop on the income side. It is only their savings and assets that they have to rely on — no one else has anything to leave them.

Financial planning needs to be very intentional to ensure they can support themselves for the remainder of their lives first and foremost. Planning for the goals of what they want to do and accomplish during their retirement years and for their potential long-term care needs is crucial.

Living single and alone in retirement is a choice, not without challenges. It is especially important for single individuals approaching retirement to work with the appropriate professionals to plan for their second stage in life. With proper planning, living alone and single and alone in retirement can be done successfully.

Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®