As if you didn’t have enough to do around the holiday, add this to your list … start thinking about contributing to your retirement plan, if you haven’t already. You have until April 15th to make a contribution for 2011, but first you need to figure out what kind of IRA to fund … a traditional or a Roth. Do you take the tax hit now with a Roth or do you pay later with a traditional IRA? First things first -- consider that most people will have somewhat less annual income later in life, when they are done working. If working years are typically our high income years, then why choose a Roth or convert savings to a Roth when we are working? Why pay a higher tax on retirement dollars now than you will later?

As if you didn’t have enough to do around the holiday, add this to your list … start thinking about contributing to your retirement plan, if you haven’t already. You have until April 15th to make a contribution for 2011, but first you need to figure out what kind of IRA to fund … a traditional or a Roth. Do you take the tax hit now with a Roth or do you pay later with a traditional IRA? First things first -- consider that most people will have somewhat less annual income later in life, when they are done working. If working years are typically our high income years, then why choose a Roth or convert savings to a Roth when we are working? Why pay a higher tax on retirement dollars now than you will later?

It may come as a surprise, but there are some situations when it makes sense to go ahead and bite the tax bullet now. If you happen to have a special situation where your income is considerably lower now (or during a working year), then consider a Roth or Roth conversion. Maybe you have excessive business expenses or losses that can be deducted in a year, or perhaps you've had a very low income year due to the slow economy or due to a job loss. Maybe you or your spouse went back to school or stayed home with a baby and the household income has been cut in half … all are good reasons to go with a Roth.

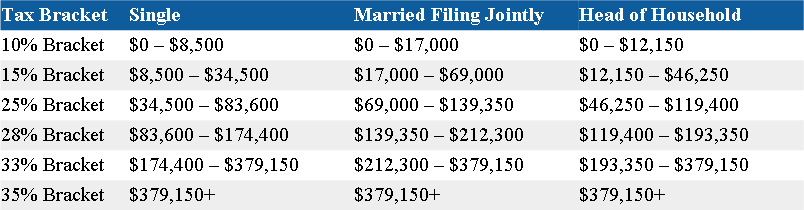

There is another important consideration. If you believe that the tax brackets and/or tax system will be changed on us, your decision could be much different depending on your expectation. For example, if you feel that tax rates on your retirement dollars will be increased substantially between now and retirement, you might want to hedge your bets and implement a larger Roth allocation into your overall tax strategy. Even if it means you pay some unwanted taxes now, obviously this could help you from paying an even larger tax later.

It's important to consider a diversified tax strategy as you would a diversified portfolio and to treat each year as a new decision for contributions and/or conversions. It’s never a one-time solution.

Withdrawals on a traditional IRA are subject to income taxes and, if withdrawn prior to age 59 1/2, may also be subject to a 10% federal penalty. Contributions to a traditional IRA may be tax-deductible depending on the taxpayer’s income, tax-filing status and other factors. In a Roth IR, contributions are made after-tax. The account grows tax-deferred and qualified distributions are tax-free. Unless certain criteria are met, Roth IRA owners must be 59 ½ or older and have held the IRA for five years before tax-free withdrawals are permitted.

In a Roth IRA conversion, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. You should discuss any tax or legal matters with the appropriate professional.