This March, in honor of Women’s History Month, I’d like to share a little about Muriel Siebert, a legend on Wall Street and a trailblazer for women. In 1967, she was the first woman to buy a seat on the New York Stock Exchange. This accomplishment, as well as her other successful business ventures and philanthropic activities, helped to expand opportunities for women in finance.

As March exits and we transition to April, many of us are busy with tax preparation leading up to the April 15th deadline for filing. Now is the time to follow the trailblazing example of Muriel Siebert and blaze a path to your own financial independence. Are you getting a refund?

Here are some tips to help you make the most of this once in a year windfall:

Ask why you have a refund. Did you pay too much in the first place? Has something changed in your financial picture? Or is it a forced saving strategy?

Set some aside. Treat the refund as income and save a minimum of 15% for longer-term goals that are important to you.

Pay down debt obligations. Especially credit card debt or student loan debt with high interest charges.

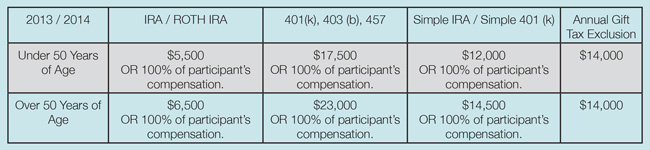

Not maxing out your 401k? A strategy for reducing future taxes is to increase your 401k contribution and then set aside the current refund to help with monthly cash flow if needed.

Are you saving for college educations? If additional funds are needed, use the refund to put savings goals back on track.

Splurge! Set it aside for gifts, vacations and other lifestyle choices.

As Women’s History month comes to an end and April 15th approaches, celebrate your commitment to making the most of your financial opportunities. Take a look back at the success you have experienced along the way and continue to step forward into your financial plan for the future.

Laurie Renchik, CFP®, MBA is a Partner and Senior Financial Planner at Center for Financial Planning, Inc. In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie was named to the 2013 Five Star Wealth Managers list in Detroit Hour magazine, is a member of the Leadership Oakland Alumni Association and in addition to her frequent contributions to Money Centered, she manages and is a frequent contributor to Center Connections at The Center.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served. C14-006593