Contributed by: Sandra Adams, CFP®, CeFT™

If you’re like me, this is the time of year to go through my files and piles of paperwork in preparation for income tax season. Seeing the stacks of statements and paperwork I’ve collected makes me feel like I’m a prime candidate to be on an upcoming episode of “Hoarders,” because I never quite feel like I can get rid of things…I might need them someday.

Consult with your financial planner and your CPA for discarding any financial or income tax paperwork, and your attorney before parting with legal paperwork. AND REMEMBER: you should shred any paperwork with identifying names, addresses, dates of birth or account or Social Security numbers on them to avoid being a potential financial fraud victim.

To ease your mind as you purge your financial records, here are some document retention guidelines:

(CLICK HERE TO DOWNLOAD YOUR PDF COPY)

Bank Statements: Keep one year unless needed for tax records.

Cancelled Checks: Keep one year unless needed for tax records.

Charitable Contributions: Keep with applicable tax return.

Credit Purchase Receipts: Discard after purchase appears on credit card statement if not needed for warranties, merchandise returns or taxes.

Credit Card Statements: Discard after payment appears on credit card statement.

Employee Business Expense Records: Keep with applicable tax return.

Health Insurance Policies: Keep until policy expires, lapses or is replaced.

Home & Property Insurance: Keep until policy expires, lapses or is replaced.

Income Tax Return and Records: Permanently.

Investment Annual Statements and 1099's: Keep with applicable tax return.

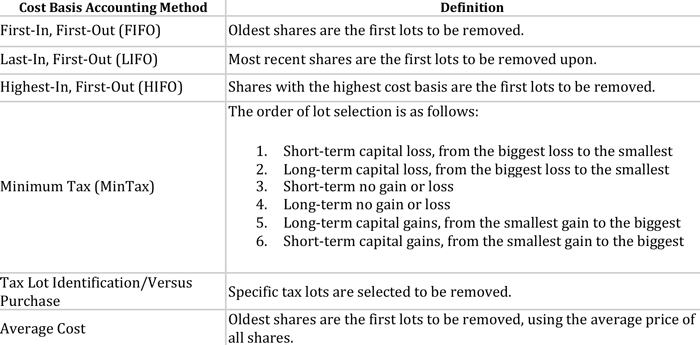

Investment Sale and Purchase Confirmation Records: Dispose of sale confirmation records when the transactions are correctly reflected on the monthly statement. Keep purchase confirmation records 3-6 years after investment is sold as evidence of cost.

Life Insurance: Keep until there is no chance of reinstatement. Premium receipts may be discarded when notices reflect payment.

Medical Records: Permanently.

Medical Expense Records: Keep with applicable tax return if deducted on tax return.

Military Papers: Permanently (may be required for possible veteran's benefits).

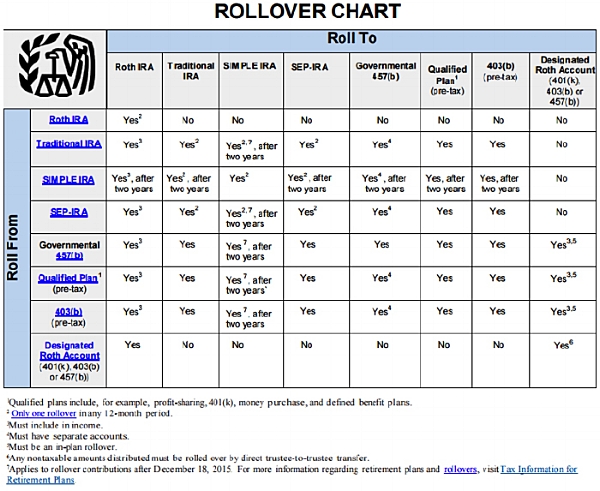

Individual Retirement Account Records: Permanently.

Passports: Until expiration.

Pay Stubs: One year. Discard all but final, cumulative pay stubs for the year.

Personal Certificates (Birth/Death, Marriage/Divorce, Religious Ceremonies): Permanently.

Real Estate Documents: Keep three to six years after property has been disposed of and taxes have been paid.

Residential Records (Copies of purchase related documents, annual mortgage statements, receipts for improvements and copies of rental leases/receipts.): Indefinitely.

Retirement Plan Statements: Three to six years. Keep year end statements permanently.

Warranties and Receipts: Discard warranties when they are clearly expired. Use your judgment when discarding receipts.

Will, Trust, Durable Powers of Attorney: Keep current documents permanently.

If the hoarder in you is still too nervous to part with the paper, you do have some options:

Electronically scan your important financial and legal papers and save them to a computer file; remember to back up your computer and save a copy of the list (on a disk or USB flash drive) in a safe place.

Talk to your financial advisor, who may have an electronic document management system that is storing many of your documents (and backing them up) for you.

Oh, and while you’re revving up your shredder and getting ready to make some confetti, here’s one more piece of paper to keep…this one. Go ahead, press print. Save this guide and you’ll save yourself the trouble of trying to remember it all next year.

Sandra Adams, CFP® , CeFT™ is a Partner and Financial Planner at Center for Financial Planning, Inc.® Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

and

and