Contributed by: Josh Bitel, CFP®

Contributed by: Josh Bitel, CFP®

Planning for retirement is on everyone's mind at some point in their career. But figuring out where to begin to project how much income will be needed can be a tall task. Sure, there are rules of thumb to follow, but cookie-cutter approaches may only work for some. When estimating your retirement needs, here is a quick guide to get you started.

Use Your Current Income as a Starting Point

One popular approach is to use a percentage of your current working income. Industry professionals disagree on what percentage to use; it could be anywhere from 60% to 90% or even more. The appeal of this approach lies in its simplicity and the fact that there is a fairly common-sense analysis underlying it. Your current income sustains your present lifestyle, so taking that income and reducing it by a specific percentage to reflect that there will be certain expenses you will no longer have is a good way to sustain a comfortable retirement.

The problem with this approach is that it does not account for your unique situation. For example, if you intend to travel more in retirement, you might need 100% (or more) of your current income to accomplish your goals.

Estimate Retirement Expenses

Another challenging piece of the equation is figuring out what your retirement expenses may look like. After all, a plan will only be successful if it accounts for the basic minimum needs. Remember that the cost of living will go up over time. And keep in mind that your retirement expenses may change from year to year. For example, paying off a mortgage would decrease your expenses, while healthcare costs as we age will have the opposite effect on your budget.

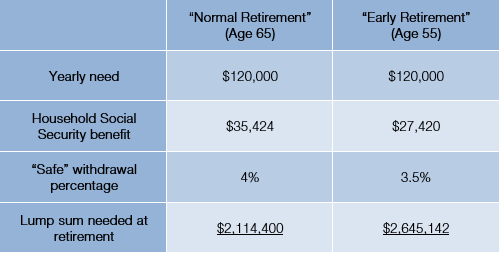

Understand How Retirement Age Can Change the Calculation

In a nutshell, the earlier you retire, the more money you will need to rely on to support your lifestyle. I recently wrote a blog simplifying this topic: click here to see more.

Account For Your Life Expectancy

Of course, when you stop working is only one piece of the pie to determine how long of a retirement you will experience. The other, harder to estimate, piece is your life expectancy. It is important to understand that the average life expectancy of your peers can play into the equation. Many factors play into this, such as location, race, income level, etc., so getting a handle on your specific situation is key. There are many tables that can be found online to assist with this; however, I always encourage people to err on the side of caution and assume a longer-than-average life expectancy to reduce the possibility of running out of money.

Identify Your Sources of Retirement Income

So you have an idea of how much you spend to support your lifestyle and how long your retirement may last, next is understanding where the money comes from. A good place to start for most Americans is Social Security. Check out http://www.ssa.gov to see your current benefit estimate. Other fixed income sources may include a pension or annuity. Beyond that, we normally rely on investments such as a 401k plan at work or other retirement plans.

Address Any Income Shortfalls

In a perfect world, we have added up our retirement lifestyle and compared it with our sources of retirement income, and found that we have plenty set aside to support a comfortable retirement. However, this is not always the case. If you have gone through this exercise and come to the conclusion of an income shortfall, here are a few ideas to help bridge that gap:

Consider delaying your retirement for a few years

Try to cut current expenses so you will have more money to save for retirement

Work part-time during retirement for extra income

As always, an advisor can help with this calculation and inspire confidence in your path to financial independence. Reach out to us today if you are thinking about that light at the end of the tunnel!

Josh Bitel, CFP® is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® He conducts financial planning analysis for clients and has a special interest in retirement income analysis.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Conversions from IRA to Roth may be subject to its own five-year holding period. Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals of contributions along with any earnings are permitted. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion. Matching contributions from your employer may be subject to a vesting schedule. Please consult with your financial advisor for more information. 401(k) plans are long-term retirement savings vehicles. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal tax penalty. Contributions to a Roth 401(k) are never tax deductible, but if certain conditions are met, distributions will be completely income tax free. Unlike Roth IRAs, Roth 401(k) participants are subject to required minimum distributions at age 72.