Contributed by: Robert Ingram, CFP®

Contributed by: Robert Ingram, CFP®

With 2019 winding down and the holidays right around the corner, it’s understandable when our personal finances don’t always get our full attention this time of year. However, you should keep several important and timely tax and financial planning strategies top of mind before the year ends. During this 60-minute discussion, we will cover the following topics and more:

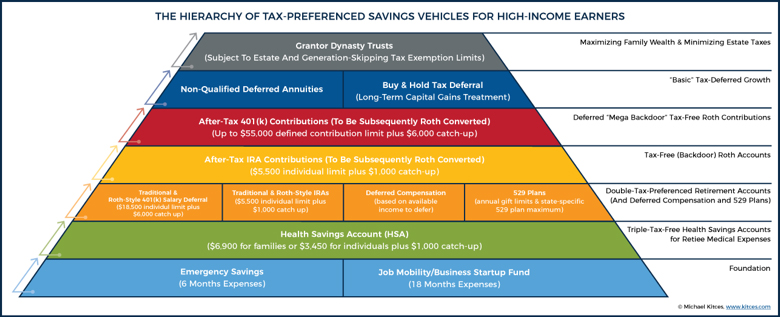

Tax planning strategies to consider for your investments and retirement accounts

Charitable giving in light of the recent tax law changes

Retirement planning tips and updates on 2020 contribution limits

If you weren’t able to attend the webinar live, we’d encourage you to check out the recording below.

There are time stamps provided so you can fast-forward to the topics you are most interested in.

3:00- Medicare Overview

6:30- Required Minimum Distributions (RMD)

12:00- Tax Reform Refresher & Income Tax Brackets

22:00- Long Term Capital Gains Rates

23:30- Efficient Charitable Giving & Donating Appreciated Securities

34:00- Roth IRA Conversions

41:00- Tax Efficient Investing & Tax Loss Harvesting

46:00- Employer Retirement Plans

49:00- Health Savings Accounts (HSA)

54:00- Gifting Ideas

Robert Ingram, CFP®, is a CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® With more than 15 years of industry experience, he is a trusted source for local media outlets and frequent contributor to The Center’s “Money Centered” blog.

Changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While familiar with the tax provisions of the issues to be discussed, Raymond James and its advisors do not provide tax or legal advice. You should discuss tax or legal matters with the appropriate professional.