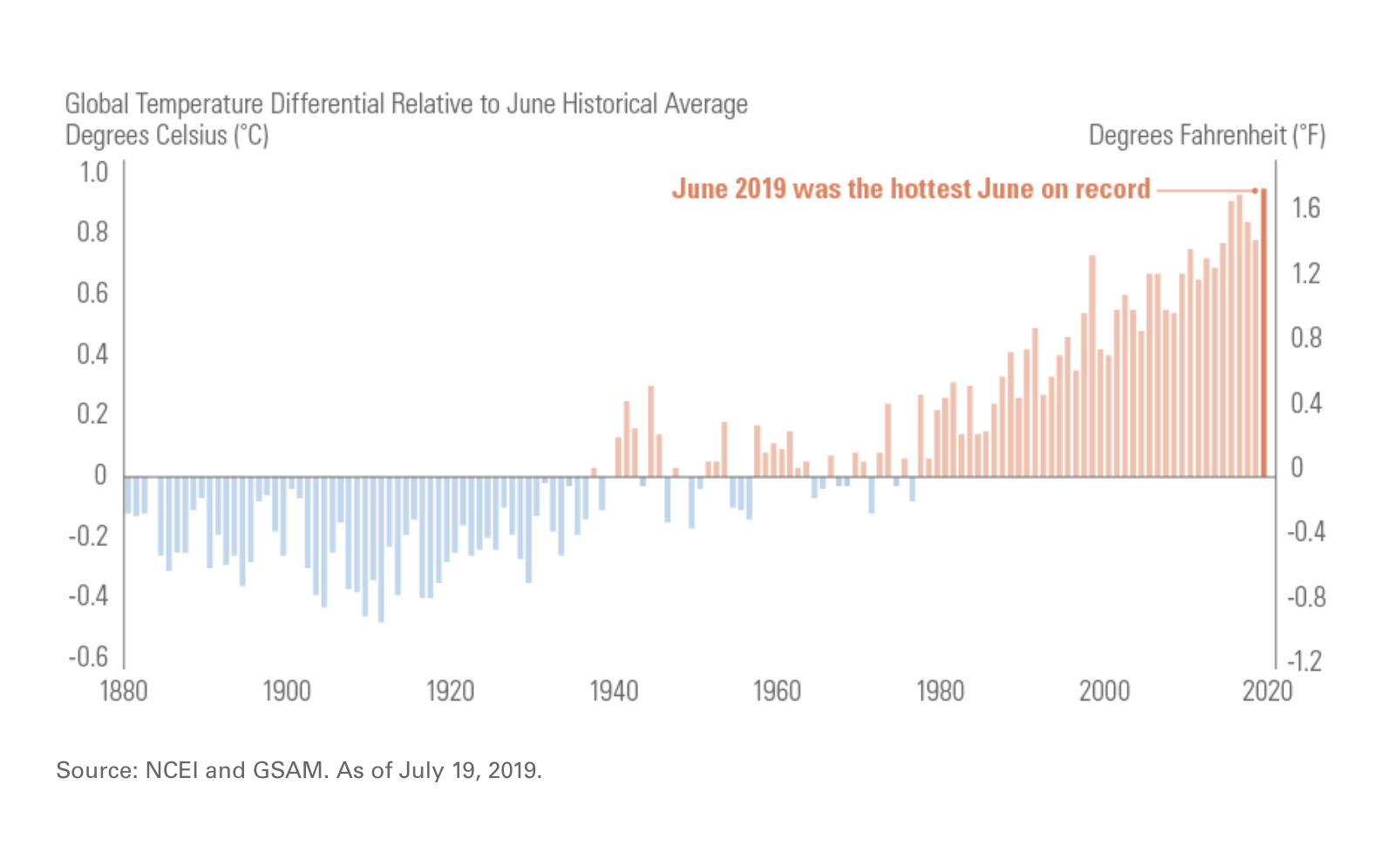

Coming in 1.71°F above its historical average of 59.9°F, June 2019 was the hottest June globally in 140 years of recorded data. June’s temperature increase is the latest in an upward trend that began in the 1970s. While debates hotter than any June persist about the validity of global warming, the fact remains that climate change carries significant implications for individuals, industries, and investors alike.

Industry and Economic Impact

Not convinced Mother Nature can wreak havoc on your day-to-day life? Just ask any New Yorker who recently experienced a heatwave, flooding, and power outages all in the same week. In fact, there’s no need to look that far; as of this writing, some Detroiters are still hoping to regain power after incredibly warm weather hit the region.

While it’s pretty clear how extreme weather conditions generate problems for energy companies, heatwaves can disrupt other industries. Manufacturing plants experience reduced production when temperatures soar above 90 degrees; fewer people look for homes, which affects the real estate industry’s most active season; and increased hospitalizations impact insurance companies. While these problems more directly speak to developed, urban areas and industries, they don’t even begin to define the potential implications of climate change around the globe.

Goldman Sachs summarized it best: “We believe that in addition to environmental impact, direct damage from mortality, labor productivity, agriculture, energy demand, and coastal storms may also significantly impact overall economic growth.”

Investors Demand More

It’s no wonder 477 global investors (including money managers and large pension funds around the world) issued a letter to governments attending the G-20 summit in Osaka, Japan. Commanding $34 trillion in assets, they’ve concluded that ignoring the Paris Agreement’s mission would create “an unacceptably high temperature increase that would cause substantial negative economic impacts.” Investors created the letter to petition government leaders to achieve the 2015 Paris Agreement goals, accelerate private sector investment into low carbon transition, and commit to improved climate-related financial reporting.

Be the Change

These investors also use their substantial financial weight to speak with companies in their portfolios about how they are addressing and alleviating industry-specific climate change issues. Individual investors can take a similar approach, by using their financial power to invest in mutual/exchange traded funds that evaluate the environmental, social, and governance (ESG) qualities of companies in their portfolios, as well as more traditional methods of research.

Are you ready to be the change?

Learn more about The Center’s Social Portfolio and ESG investing here.

Jaclyn Jackson is a Portfolio Administrator at Center for Financial Planning, Inc.® She manages client portfolios and performs investment research.

Investors should carefully consider the investment objectives, risks, charges and expenses of Mutual Funds and Exchange-Traded Funds (ETFs) before investing. The prospectus and summary prospectus contains this and other information about Mutual Funds and ETFs. The prospectus and summary prospectus is available from your financial advisor and should be read carefully before investing.

Opinions expressed are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

SOURCES: https://www.pionline.com/esg/investor-group-pleads-g-20-global-warming https://theinvestoragenda.org/wp-content/uploads/2019/06/FINAL-at-June-24-Global-Investor-Statement-to-Governments-on-Climate-Change-26.06.19-1.pdf