After working with retirement clients for nearly 30 years, I have learned many things. One of the most important lessons I have learned is that we all need to have the answer to one very simple question before we begin the planning process -- “what does it cost for me to live per month”? As planners we can develop scenarios to help achieve retirement goals, but if we start with the wrong premise, we may be forming strategies to meet the wrong goal.

After working with retirement clients for nearly 30 years, I have learned many things. One of the most important lessons I have learned is that we all need to have the answer to one very simple question before we begin the planning process -- “what does it cost for me to live per month”? As planners we can develop scenarios to help achieve retirement goals, but if we start with the wrong premise, we may be forming strategies to meet the wrong goal.

Why is it so difficult to come up with a figure for our income needs? The general tendency is to underestimate expenditures and overestimate income. We also think about what we should be spending, not what we do spend. Not knowing our expenditures comes about because we forget a few things:

- Food, shelter, transportation and clothing are only the beginning of expenses. They are the ones we see each month.

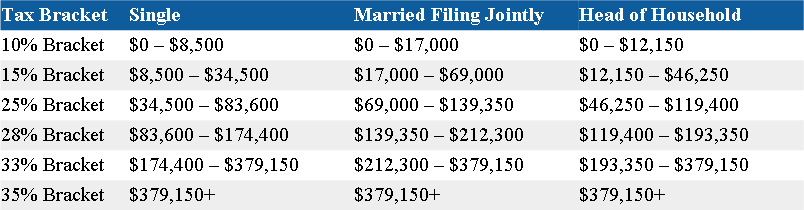

- We need to add insurances, taxes, gifts, car replacements, vacations, travel, family visits, and hobby and entertainment expenses.

- If you have children, your educational expenses may drop off by the time you retire but you need to determine how much you might need for weddings and launching (yes—getting your darlings out of the parental home)

- If you plan to change your living arrangements, you need to factor in not only the additional cost of making a change but also the change in monthly expenditures related to the move.

There are circumstances that are out of our control, such as the rising cost of health care and insurance, declining markets and inflation. To guard against these events we need to factor in percentage increases over time and to have a savings cushion of at least six months to help us weather the storm.

When I have gone through this analysis with clients, I often find a dramatic difference between projected income needs and actual income needs. Can you imagine trying to reach your destination with only half a tank of gas? It doesn’t work. Using the wrong expenditure figure can ruin the lifestyle you anticipated.

Talk to your financial advisor about tools to help you track your monthly income needs.