It is summer time! So, if you get a few minutes in between all of the outdoor activities here are 7 quick financial planning strategies to review. As always, if we can help tailor any of these to your personal circumstances feel free to reach out.

By now you have heard there is a new tax law. Because we will not experience the actual affects until next April, many of us are not sure how it applies to our specific circumstances.

Do a quick tax projection with your tax preparer and check your tax withholding. Many of us will have an overall tax decrease – but withholdings from our paychecks also went down. Do not get caught off-guard. More importantly, some folks will see higher taxes due to the new limitations on certain itemized deductions. Combine this with lower withholding and you have a double whammy (read: you will be writing a bigger check to the IRS).

Lump and clump itemized deductions. The standard deduction has increased to $24k for married couples filing jointly. In addition, miscellaneous itemized deductions have been removed completely. $10k cap. For some. Lumping charitable deductions in one year to take advantage of itemizing deductions and then taking the standard deduction for several years might be best.

Utilize QCD’s. If you are over age 70.5 and making charitable contributions, you should consider utilizing QCD. Don’t know what QCD stands for? Call us now.

Consider partial ROTH conversions to even out your tax liability. If you are retired, but not yet age 70.5 (when RMD’s start). Don’t know what an RMD is? Talk with us today! If you are in this group, multiyear tax planning may be beneficial.

Most estates are no longer subject to the estate tax given the current exemption equivalent of $11.2M (times 2 for married couples). However, income taxes remain an issue to plan around. One of my favorites: Transfer low basis securities to aging parents and then receive it back with a step up in basis. If you think you might be able to take advantage of this let us know.

Review your distribution scheme in your Will or Trust. Are you using the old A-B or marital/credit shelter trust format? Do you understand how the increased exemption affects this strategy?

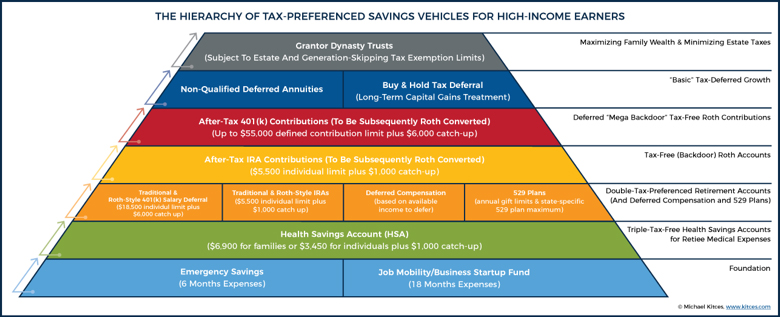

How should high-income folks prioritize their savings?

Are you in the new 37% marginal bracket? If so, consider contributing to a Health Savings Account IF eligible. Next, consider making Pretax or traditional IRA/401k contributions. However, if you reasonably believe that you will be in the highest marginal tax bracket now AND in retirement – then the ROTH may be suggested. Know that for the great majority of us this will not be the case. Meaning, we will be in a lower bracket during our retirement years than our current bracket. Next, use Backdoor ROTH IRA contributions. If your employer offers an after tax option to your 401k plan, take advantage of it. You can then roll these funds directly into a ROTH. Next, consider a non-qualified annuity that provides tax deferral of earnings growth followed by taxable brokerage account.

If you have not received a copy of our 2018 Key Financial Data and would like a copy let us know!

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc.® and is a contributor to national media and publications such as Forbes and The Wall Street Journal and has appeared on Good Morning America Weekend Edition and WDIV Channel 4. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), mentored many CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Tim Wyman and not necessarily those of Raymond James. Investments mentioned may not be suitable for all investors. Unless certain criteria are met, Roth IRA owners must be 591⁄2 or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. A fixed annuity is a long-term, tax-deferred insurance contract designed for retirement. It allows you to create a fixed stream of income through a process called annuitization and also provides a fixed rate of return based on the terms of the contract. Fixed annuities have limitations. If you decide to take your money out early, you may face fees called surrender charges. Plus, if you're not yet 591⁄2, you may also have to pay an additional 10% tax penalty on top of ordinary income taxes. You should also know that a fixed annuity contains guarantees and protections that are subject to the issuing insurance company's ability to pay for them. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.