From a financial-readiness perspective, many clients target age, monetary or benefit milestones to help them determine when they will be ready to retire:

“When I have $1 million in assets saved, I will be ready to retire.”

“When I am eligible to collect Social Security, I will be ready to retire.”

“When I am eligible to collect my company pension OR I have reached my XX anniversary with my company, I will be ready to retire.”

“When I am eligible to receive Medicare, I will be ready to retire.”

The real answer is, some or all of these may be true for you, and some or all of these may be false.Every client situation is different and no general guideline can determine whether or not you are financially ready to retire. Unfortunately, it is far more complicated than that. There are numerous financial factors that go into determining financial readiness.Let’s take a deeper look into the issues.

Financial Readiness Issues:

Retirement Savings:

Do you have enough saved?

What might your other retirement income sources be (Social Security, Pensions, etc.)

How much income will you need (what are your fixed costs versus lifestyle wants in retirement), and

What are your longevity expectations (how long might you expect to live based on health, family history, etc.—expect it will be longer than you think!).

Where are your savings?

Do you have retirement savings outside of retirement plans?

Do you have some after-tax and reserve cash/emergency reserve savings?

Do you have different types of accounts to provide tax diversification going into retirement (i.e. IRAs/401(k)s, ROTH IRAs, after tax investment accounts)?

Debt:

Have you paid down your debt or do you have a plan to be as debt free as possible by the time you retire? This will allow you to control your retirement income for other fixed expenses and wants; it is desirable to have as little debt/fixed expenses as possible going into retirement as possible.

Retirement Income:

A large part to being retirement ready is understanding your retirement income sources, options and strategies and using them to your best advantage. Take the time to consult with your planner to choose the option that works best for you and your family circumstance.

Pensions: Do you understand all your options, including the income options available to your spouse as a survivor upon your death. We find that in many cases it makes sense to choose an option that includes a lifetime income option for you with at least a 65% survivor income benefit for your spouse if you were to die first.

Social Security: While many are under the false impression that because you are allowed to take Social Security benefits as early as age 62, they should, we might recommend otherwise. For most individuals now approaching Social Security claiming age, Full Retirement Age for claiming Social Security is now age 66 and delaying benefits until age 70 results in an 8% per year increase in benefits. Knowing and understanding the Social Security benefits, rules and strategies that can be employed, especially for married couples, to ensure the largest lifetime benefit can be an added supplement to long-term retirement income. We find that our most successful married couples in retirement employ a strategy where the lower Social Security earner draws at Full Retirement age while the higher Social Security earner waits to draw at age 70, insuring the highest possible Social Security benefit for the spouse that lives the longest.

Investments:

Preparing for retirement involves making appropriate adjustments to your investment strategy. You should work with your financial planner to adjust your asset allocation to one that is appropriate for your new goals and time horizon. We find that our most successful retirees tend to have asset allocations ranging from 40% Bond/60% Stock to 50% Bond/50% Stock.

Insurance:

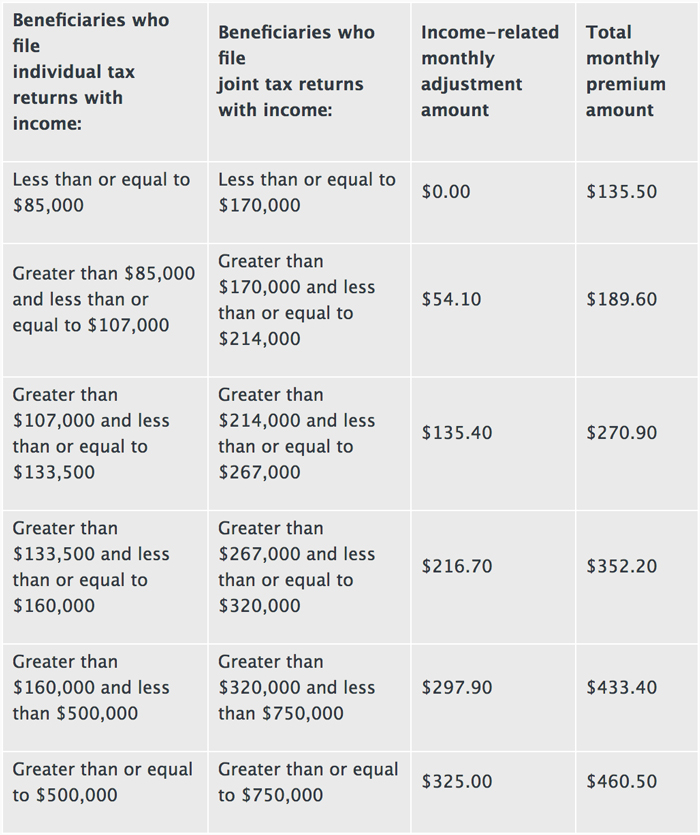

For those retiring before age 65 (Medicare eligibility) and without retiree healthcare, finding health insurance to bridge them to Medicare is a must.

Retirement readiness does require addressing the issue of Long Term Care funding Having a plan, no matter what your choice, is something that must be done before retirement.

Estate Planning:

While not exactly monetary, having your estate planning documents (Durable Powers of Attorney, Wills and possibly Trust or Trusts in place) updated prior to retirement is a good idea.Part of this is making sure accounts are titled properly, beneficiaries are updated, and account holdings/locations and management are as simplified as possible going into your last phase of life.

Once you have determined your financial retirement readiness, you need to determine your personal retirement readiness, which may be even more difficult for many folks. Why? Many have spent the majority of their lifetimes to this point building careers that established them with titles, credentials and stature. They built reputations, networks, social and business circles and were well respected because of the work that they have done. And now they are moving from that phase of their lives to another and that means starting over. What will they be now? What will their lives mean? And to whom?

Until you are ready to start the next phase of your life knowing your purpose – what you want to wake up for every day – you are likely not ready for retirement. Those that have not given the thought to their mission, values, and their “why” for their next phase will be left feeling lost and will likely fail at retirement and find themselves wanting to go back to their former lives.

How can you find your purpose?

Ask yourself what is most important to you? (family, friends, spirituality, charity,etc)

Ask yourself what are your life priorities? (family, health, knowledge, etc.)

Ask yourself what you want to let go of and what you want to give yourself to.

Realize that the rest of your life can be the best of your life if you embrace it with an open mind and enthusiasm.

Consider reading the book “Purposeful Retirement” by Hyrum Smith if you need more help!

“Am I ready to retire?” It is not a simple question and there is no simple answer. It may take months or years to answer all of the questions and make all of the preparations. If you think that retirement is in your not too distant future, the time is NOW to start planning. Don’t let retirement sneak up on you…work with your financial planner and be Retirement Ready!

Contributed by: Center Investment Department

Contributed by: Center Investment Department